“Laughing out loud!”

Mitt Romney is giving oil executives a good reason to vote for him. (Making, by our count, 465,361 such reasons.) From the Center for American Progress:

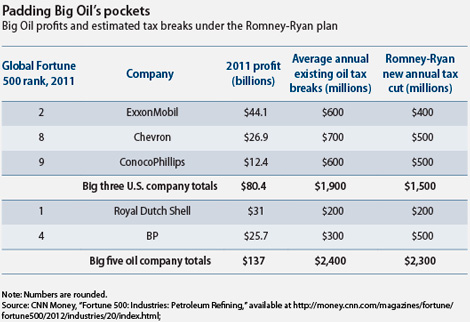

The world’s five biggest public oil companies—BP, Chevron, ConocoPhillips, ExxonMobil, and Royal Dutch Shell—would keep special tax breaks worth $2.4 billion each year. And by cutting corporate tax rates, the Romney plan could lower the companies’ annual tax bill by another $2.3 billion, based on an analysis of the companies’ tax expense for 2011. The special tax breaks, supplemented by Gov. Romney’s lower corporate rates, could benefit the oil companies by more than $4 billion annually.

Ha ha. Perfect! Finally — finally! — oil companies will be able to make a buck or two!

Here’s CAP’s breakdown of what the five largest oil companies in the world — half of the 10 largest corporations in America — stand to get from Romney’s tax proposals.

Take Chevron, for example: A company that earned $26.9 billion dollars in 2011 would see — if you add the right two columns together — a $1.2 billion tax break. Which is helpful, because Chevron has its eye on a new yacht.

And a new island.

And a new president.