When they're not making massively leveraged bets on the collapsing value of your savings account, the world's largest banks are doing their best to destroy the ability of this planet to support human life, says a new report.

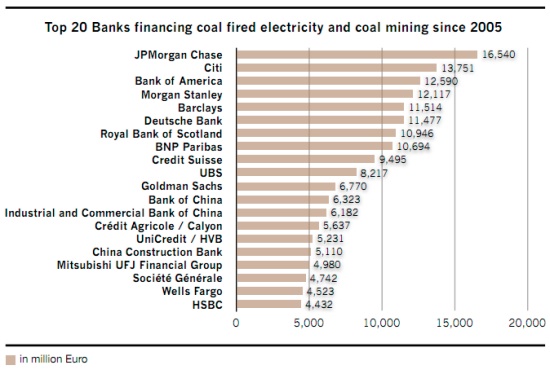

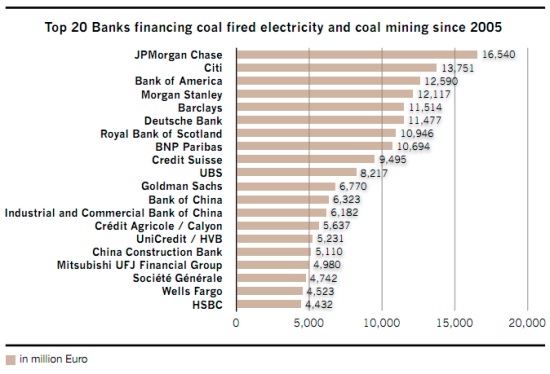

Watchdog group BankTrack investigated which banks are financing Big Coal, and discovered that America's largest financial institutions are knee-deep in the stuff. JPMorgan Chase, Citi, Bank of America, Morgan Stanley, Goldman Sachs, Wells Fargo, HSBC — they all dominated the industry. Incredibly, China's two biggest banks don't even crack the top 10, even though China is the biggest producer and consumer of coal in the world.

Oh, plus, the banks are lying to your face about it. Here's a list of over-the-top greenwashing compiled by BankTrack from the worst offenders.

JPMorgan Chase: “Helping the world transition to a low-carbon economy”

Citi: “Most innovative bank in climate change”

Bank of America: “The most formidable challenge we face is global climate change.”

Morgan Stanley: “(…)make your life greener and help tackle climate change.”

Barclays: “Managing the climate change risks of our operations and those of our clients."

Deutsche Bank: “Climate change is the dominant environmental issue of our time and one where we can make a significant contribution.”

Royal Bank of Scotland: “As a financial services group our direct impact on the environment in terms of climate change (…) is limited.”

BNP Paribas: “A strong commitment to combating climate change”

Credit Suisse: “Credit Suisse cares for climate.”

UBS: “Addressing climate change on a global scale will require an unprecedented mobilization of private sector investments.”

Goldman Sachs: “Goldman Sachs is very concerned by the threat to our natural environment, to humans and to the economy presented by climate change.”

Bank of China: “As a responsible corporate citizen with a global presence, we are committed to responding to the challenge of climate change."

Industrial and Commercial Bank of China: “As an advocate and executor of 'green banking,' the Bank is actively advocating a low-carbon way of living.”

Credit Agricole: “Combating climate change is central to our strategy.”

UniCredit: “The group reiterates its commitment to the achievement of the goals of the Kyoto Protocol in all countries where it has a presence.”

China Construction Bank: "CCB’s strategic objective is to become a low carbon bank.”

Mitsubishi Financial Group: “We will channel our full capabilities into working toward the benefit of the environment and future generations."

Societe Generale: “As a community of 135,000 employees, we are aiming to control and reduce our own carbon footprint.”

Wells Fargo: “We want to help our customers and nation transition to a cleaner, more sustainable lower-carbon economy.”

HSBC: “HSBC adopts a cautious approach to activities which contribute significantly to climate change.”

It's important to remember that banks have more power than almost any other institution to shape what gets done on this planet, says BankTrack's statement accompanying the report:

Through their lending, investment, and other financial services, commercial banks play an indispensable role in mobilizing and allocating financial resources for the private sector. As such, they are in a unique position to either help further entrench patterns of energy production and intensive energy use that are based on the burning of fossil fuels, or to catalyze the necessary transition to an economy that minimizes GHG pollution and relies on energy efficiency and low/no carbon energy sources. BankTrack believes that with this influential position comes a special responsibility for banks to play a leadership role in addressing the challenges of climate change.

Which is not to say that anyone thinks these institutions are about to grow a conscience.

So if you were thinking about ditching your bank in solidarity with the Occupy Wall Street movement, now you've got one more reason to make the switch.