How did you fare during the great food-price spikes of 2008 and 2011?

If your response to this question is, “Um, what food-price spikes?”, then you are like me and, probably, most other readers here. Yes, I saw the occasional scary-looking graph in the newspapers, but that’s all it was — a line jagging up and up and up. It never hit my wallet. A graph is much easier to deal with than a loaf of bread that maxes out my credit card.

That’s because I’m privileged to have a credit card and spend little — a little more than 10 percent of my income — on food, the World Bank economist John Baffes told me. “A 20 percent change in the price of food means absolutely nothing to me,” he said. “I probably wouldn’t notice if a loaf of bread went from $2.00 to $2.40. But for someone who is spending 80 percent of their income on food, it can bring you into poverty.”

I’ve heard lots of explanations for these food-price spikes — and they are often shaped to support some other agenda. I’ve heard people who want more regulation arguing that the spikes were mostly caused by financiers gambling on the price of food, and therefore we should strictly regulate markets. I’ve heard industrial ag-vocates arguing that the spikes were caused by a shortage of food, and therefore we should help small farmers in Africa and Asia replicate big, North-American style agriculture.

As you can see, people use the spikes as a talking point to support totally contrary arguments. I wanted to know what the real culprits were.

By now, enough time has gone by that there is a general agreement among economists. Yes, there are some interesting disagreements about which culprits were most important — I’ll get to that in a second. But if you want the short and simple takeaway, here it is: We got closer to the bottom of the world grain barrel than we have in decades, which made the market fragile, and then several other factors keyed things off. This is where it gets murky — bad weather? biofuels? banker speculation? Take your pick or mix them together. All the arguments are over which of these “other factors” mattered most.

Otherwise, there’s consensus that the first part — about grain stocks getting close to the bottom of the barrel — was a long-term background trend shaping the crisis on a deeper level.

Christopher Barrett, an economist at Cornell who came out with a book on this subject last year (Food or Consequences: Food Security and Its Implications for Global Sociopolitical Stability), said that, in the long term there is a very real narrowing between the amount of food people grow and the amount they eat. We grow a little more each year, but growth in yields has been leveling off. At the same time, the population is growing.

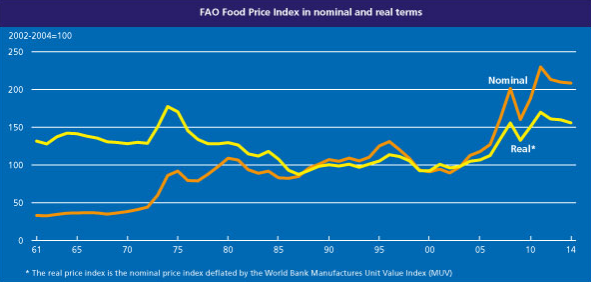

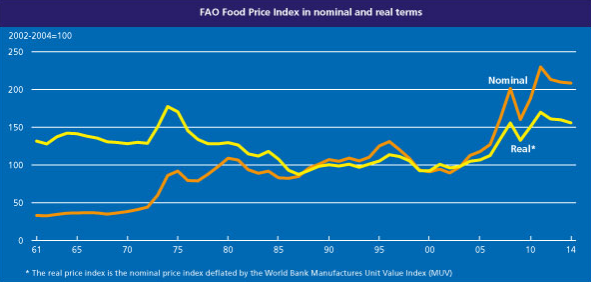

There’s a simple way to measure the difference between food production and consumption: It’s called price. As you can see, it has indeed gone up, though it has been higher.

FAO

In the 1960s and 1970s, world leaders were terrified that food shortages would lead to famines or communist revolutions, so they poured money into ag research. Yields boomed, prices dropped — and all of a sudden, the problem wasn’t too little food, but too much. In the 1990s, the major concern was that industrialized and subsidized farms were “dumping” so much cheap grain on the market that smaller farmers in poorer countries couldn’t compete, Barrett said. “Governments became rather complacent,” he said. “We didn’t keep ahead of it.”

As a result, food stocks were lower than usual when the 2011 price spike hit, coinciding with the Arab Spring revolutions. World leaders got nervous, and they became interested in agriculture research again. There was still plenty of food to (in theory) feed everyone, but there wasn’t as much slack in the system.

As far as I can tell, everyone studying this sort of thing pretty much agrees up to here. It’s when you start talking about the actual, proximate causes that all the arguments break out.

There were several probable culprits. People in China were eating more meat, which meant there were more animal farmers bidding for feed grain. There were more financiers speculating on food price. (Barrett says “I just don’t see it” as a major cause, though another group of economists — Rosegrant et al. — who contributed a chapter to his book concluded that “financial speculation likely added to price volatility as market uncertainty reached its peak.”)

There were poor harvests because of severe weather. And as prices began to rise, several countries panicked and began hoarding grain. But, Barrett said, “The single biggest precipitating event was this crazy energy policy that relies inappropriately on biofuels.” It was the UC Berkeley economist Brian Wright who most convincingly made the case that conversion of cropland to biofuels was the main cause of the price hikes, and that’s fairly accepted now, Barrett said.

Of course there are dozens of differing conclusions that re-arrange these culprits in order of importance. Baffes is one of the experts who disagree with biofuels theory. “Just 2 percent of global arable land was diverted for biofuels,” he said. “I don’t think it’s enough to cause a big effect.” He thinks rising incomes in places like China were also less important than many people think. The real cause of the price spikes, Baffes argues, was a spike in the cost of energy.

Baffes grew up on a farm in southern Greece, which his brother still runs. He said, “When I go to the farm, everywhere around me is energy-intensive material. There is the tractor going back and forth. There is the truck going back and forth. There is the water for irrigation that comes from a pump hooked into the power grid. Next to you there is fertilizer produced with petroleum. Next to you there are other chemicals. Everything requires energy.”

If price spikes are caused by biofuels cutting into the global food supply, then the solution would be to farm more land (perhaps reclaiming biofuel land), or to grow more food on existing farms. But if the spikes are caused by skyrocketing petroleum prices, then the solution would be to make agriculture less energy-intensive, or to develop alternative forms of energy.

Keep in mind that this is a minority view. “Five years ago, I would say I was alone,” Baffes said. “Now I think a lot more people are looking at the picture and recognizing that energy is a key issue.”

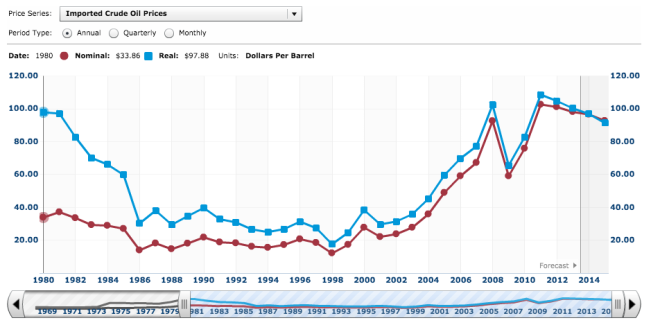

I mean, look at this graph of crude oil prices. Doesn’t that look familiar?

FAO

As I started out by saying, it’s tempting to cherry-pick a cause of food price spikes. I can see for myself just how tempting: If it turns out that food prices really do rise in tandem with energy prices, that would provide a hefty incentive to decouple agriculture from fossil fuels. I like that idea!

But I’ll refrain from using the threat of price spikes to push my subversive solar-farming agenda until there’s more solid evidence. What is clear is that, beneath the price spikes, on a longer term, food prices are gradually but definitely rising. And that, in turn, indicates a smaller and smaller gap between how much we grow and how much we eat.