This story is published in partnership with the Reno Gazette-Journal, with support by The Water Desk, an independent journalism initiative based at the University of Colorado Boulder’s Center for Environmental Journalism.

For the first two decades of the 21st century, not even a once-in-a-millennium drought could deter real estate developers from building vast suburban tracts on the wild edges of Western U.S. cities. But in 2021, a reckoning appeared on the horizon. The Colorado River sank to historic lows, winter rains never arrived, and communities from California to Texas found their groundwater wells going dry after decades of overuse.

Western officials had seldom let questions about water availability get in the way of population growth, but suddenly they seemed to have no other choice. Faced with an unprecedented shortage, many local governments tried to pump the brakes on new developments. A small town in Utah halted all new housing permits, fearful that more homes would sap a local river. A suburb of Colorado Springs, Colorado, told developers that it could no longer allow new subdivisions to connect to the city’s water system. Most significantly, the state of Arizona has all but paused new housing in some Phoenix suburbs, citing a shortage of groundwater.

This pivot to conservation was bad news for D.R. Horton, the nation’s largest homebuilding company. Buoyed by pandemic-induced demand for cheap, spacious housing across the West, Horton netted $6 billion constructing more than 80,000 homes last year alone. The company had long been able to assume that if it built a development, someone else would provide water for it — usually a local government eager for tax revenue. All of a sudden, Horton had to find the water itself.

Luckily, there was a third party who could help.

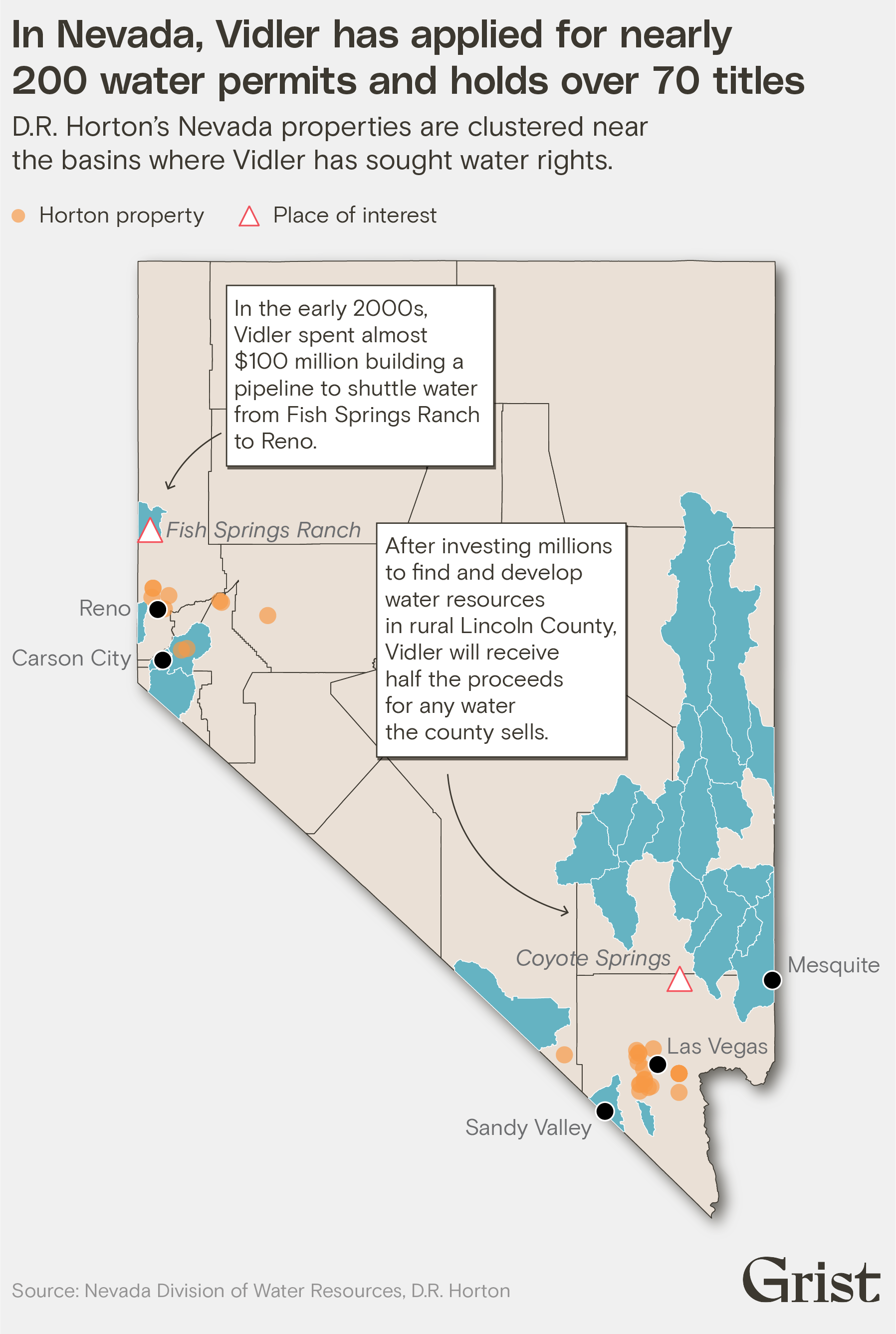

In April of last year, Horton acquired Vidler Water Company, a tiny outfit whose dozen employees worked out of an unassuming faux-Mediterranean office park in Carson City, Nevada. Though Vidler’s annual revenue was less than a tenth of a percent of Horton’s, the real estate titan spent big to snap it up: The price tag on the acquisition was an eye-popping $291 million.

Vidler is an unusual company. It doesn’t actually deliver water to people, nor does it own any facilities for water treatment or desalination. Instead the company functions as a broker for water rights, finding untapped water in rural communities and marketing it to developers and corporations in fast-growing cities and suburbs. For 20 years, the company has bought up remote farmland and drilled wells in bone-dry valleys to amass an enormous private water portfolio, then made tens of millions of dollars by selling that portfolio one piece at a time.

This kind of business inevitably involves some guesswork, and often that guesswork looks like classic real estate speculation: You can make money by bringing water to places where people already want it, but you can make even more money bringing it to places where people will want it in the future. This is exactly what Vidler has tried to do, and it has led the company’s critics to contend that its business model violates the anti-speculation spirit of Western water law.

Indeed, suspicions that Vidler is profiteering off a vulnerable public resource have made the company more than its share of enemies over the years: Top officials have been pilloried in courtrooms and threatened by rural residents, and an early executive once had to jump out a window to escape an angry crowd at a public meeting.

Horton’s purchase of Vidler has no real precedent, but it is a clear indication of where the West is headed. The region has grown twice as fast as the rest of the United States since the 1950s, and national builders like Horton are relying on it to fuel future profits. If these companies want to capitalize on migration to the booming suburbs of Phoenix and Las Vegas, they’ll need to find creative new water supplies that will allow them to keep building even as regulators try to clamp down on unsustainable growth.

In this regard, Vidler is a pioneer. The company was the first in the West to make a business model out of finding and flipping water. In the past few years, a new crop of upstarts has sought to mimic this model, buying up water rights in rural areas and marketing them to developers and suburbs that need them for future growth. These companies include Water Asset Management, which has bought up agricultural land in Colorado to secure water rights, and the investment firm Greenstone, which organized a first-of-its-kind deal to move Colorado River water from farms in western Arizona to a city near Phoenix. Both companies boast former Vidler executives in top leadership positions.

Vidler still stands at the front of the pack, tapping water in hard-to-reach aquifers and pursuing aggressive litigation to push new construction forward. If the company’s tactics become more common, the effects will be far-reaching — not only could rural areas and desert ecosystems see their precious water siphoned off, but thousands of people will buy and occupy homes fed by water sources that may turn out to be unreliable. A major part of Vidler’s strategy has been to pump water from small underground aquifers, squeezing every available drop from finite water banks that may someday run dry, especially as climate change contributes to the long-term aridification of the West.

Kevin Brown is the manager of a water utility in the southern Nevada city of Mesquite, where Vidler has been trying for years to build a pipeline that could bring new water to the city. The company has proposed tapping a virgin aquifer and using the water to supply new housing developments on the edge of town, but Brown doubts the pipeline is a good idea. Instead he has focused on reducing water usage across the city and recycling water where he can.

“In the world we live in, and the market we live in, if you put enough money against it, someone will make it happen,” Brown told Grist. “If these developers aren’t building homes, then they’re going out of business. But at some point, somebody needs to say, ‘You know what, we can’t grow anymore. It’s not sustainable.’”

In most Western states, water is public property regardless of whose land it flows through or sits under. Private entities can only own the right to use that water for a specific purpose. Individuals and companies can apply to use any unclaimed water source, but they have to convince the state government that they plan to put the water to a productive use. By the same token, owners can sell or lease their existing water rights to each other as long as the buyers keep using the water for something.

In this arrangement, the new breed of water brokers has found an opportunity to accumulate assets and generate profits. But the law requires them to tread cautiously.

At the turn of the 20th century, a Transcontinental Mining executive named Rees Vidler tried to dig a tunnel through the heart of the Colorado Rockies. It was supposed to link the mineral-rich mountain towns around Breckenridge with the young Denver metro area, but Vidler never completed the project. The shaft sat unused until an engineer bought it in the 1950s and repurposed it to move water rather than ore. He acquired the rights to river water on the Breckinridge side of the tunnel, built a water pipeline through the shaft, and proposed to sell the river water to people in the fast-growing cities around Denver. The engineer didn’t have any confirmed buyers for the water, but he could store it in a reservoir until he made a sale.

In 1979, the Colorado Supreme Court dealt a blow to that scheme. A judge ruled that the engineer’s water purchases were “grounded on no interest beyond a desire to obtain water for sale.” If Colorado allowed such purchases, it would “encourage those with vast monetary resources to monopolize [water] for personal profit rather than beneficial use,” the court wrote. In other words, speculating on water was unacceptable. Judges in other states soon adopted similar rulings, creating a precedent that some legal scholars have called “the Vidler doctrine.”

About 15 years later, the Vidler tunnel and its water rights fell into the possession of one John Hart, a swashbuckling financier who was beginning a decades-long corporate takeover spree. Hart and his business partner had just taken over the Physicians Insurance Company of Ohio, or PICO. They transformed the moribund Midwestern insurance company into an umbrella corporation for buying and flipping distressed assets, including a Swiss railway operator, an Australian oil company, a million acres of rural land in Nevada, and a canola-seed crushing facility.

The Vidler tunnel’s history gave Hart an idea. He lived near San Diego, which relies in part on the Colorado River, and he could see that water was only going to get more valuable across the region, especially if real estate kept booming. Many farmers who had fallen on hard times were selling their irrigated land to developers, who repurposed irrigation water to supply new homes and golf courses. Hart wanted to profit from this slow transition away from agriculture, and he thought he saw a way to do it: Buy up water rights in the driest states, wait for the rights to rise in value, and sell them later on to developers that needed them for new housing. As long as the population of the West continued to increase, the price of water would increase as well — and with it PICO’s investment profits.

By acting as a broker for water rights, the PICO subsidiary that Hart called Vidler Water Company could get around the anti-speculation doctrine invoked in its very name. The tunnel engineer had sought to hold onto his water rights and make money by selling water to people who needed it. Vidler would just buy and sell the water rights themselves. This amounted to an elegant form of arbitrage: If a water right was worth more to a developer than it was to a farmer, Vidler could profit by flipping the right from the latter to the former.

The only problem was that Hart didn’t know very much about the nitty-gritty details of water law, and he knew even less about the science of hydrology. In order for his plan to work, he had to find someone who could handle both. That someone was Dorothy Timian-Palmer, an engineer who had been Carson City’s municipal utilities director for around a decade before Hart poached her in 1997. Timian-Palmer declined to speak with Grist, but several sources who worked with and against Vidler described her as one of the nation’s foremost water experts.

“She is the most knowledgeable person about water in the country,” insisted Hart in an interview. He recalled how he and Timian-Palmer used to attend investment conferences where skeptical audiences heard the legendary oil tycoon T. Boone Pickens talk in vague and confused terms about his water investments. But when Timian-Palmer took the stage, introduced herself as a water engineer, and started rattling off facts about hydrology and hydraulics, all the attendees perked up and started taking notes.

“She’s very smart, very shrewd, and very tough,” said Paul Hultin, a lawyer who sued Vidler over one of its later projects in New Mexico.

Armed with an infusion of cash from PICO, Timian-Palmer and a small group of Nevada-based lawyers and engineers set about flipping water. They bought agricultural water rights along a river in Colorado and sold them to Denver-area developers. They bought tens of thousands of acres of farm- and ranchland in Arizona, Idaho, Nevada, and New Mexico and either sold the water rights to urban utilities, leased them back to farmers, or sold the land to developers. In one case the company made a fivefold profit after six years.

When developers wanted to use the water they’d just acquired on former farmland, they could fallow the irrigated fields and start pumping water into their subdivisions and power plants, fueling further housing expansion. Marc Reisner, the journalist who wrote that “water flows uphill towards money” in his seminal book Cadillac Desert, also joined Vidler for a few years as a part-time political consultant, believing the company’s projects could enable growth while avoiding the construction of harmful new reservoirs and dams.

In other cases, Vidler chose to sit on the water it acquired until its value went up. In California and Arizona, the company bought and stored water in so-called “underground storage facilities,” artificial aquifers that serve as subterranean reservoirs. The cities and farmers who typically use these kinds of water banks are usually trying to squirrel away water for use during dry years, but Vidler’s goal was to profit on the gradual increase in water prices.

In California’s agriculture-heavy Central Valley, for instance, the company took partial ownership of an artificial aquifer, then flipped its share to real estate developers and water utilities, making $25 million off the transaction in just a few years. In Arizona, meanwhile, the company built its own large storage facility west of Phoenix and filled it with more than 250,000 acre-feet of water from the Colorado River. (An acre-foot is equivalent to around 326,000 gallons, or roughly enough water to supply two homes for a year.) Vidler executives wrote in a 2004 financial statement that “continued growth of the municipalities surrounding Phoenix” and “the low level of Lake Mead,” the largest Colorado River reservoir, were both “likely to increase demand” for the water.

No one has ever accused the company of breaking the law with these transactions, but its strategy clashed with the legal principles established in the 1979 ruling against the original Vidler tunnel scheme. In order for Vidler to secure new water rights, it had to identify a “beneficial use” for each water source it wanted to claim. The company would tell state regulators that it wanted to use each given water right to supply a power plant, or a suburban development, or a farm. In its own financial statements, though, the company made it clear that using water was merely incidental to the company’s mission.

“Vidler seeks to acquire water rights at prices consistent with their current use, with the expectation of an increase in value if the water right can be converted to a higher use,” the company said in a 2001 annual report. “Vidler’s priority is to develop recurring cash flow from these assets.”

Kyle Roerink, a water-conservation advocate who runs the nonprofit Great Basin Water Network, told Grist that he’s observed Vidler trying to find ways around the “beneficial use” doctrine for almost a decade.

“It’s a model where you’re trying to squeeze blood, profits, and water from stone, and they’ve been pretty successful at it,” he said. “[They’re] pushing the boundaries and testing the limits of what the foundational principles of Western water law are. It’s among the most dangerous elements of capitalism at play here.”

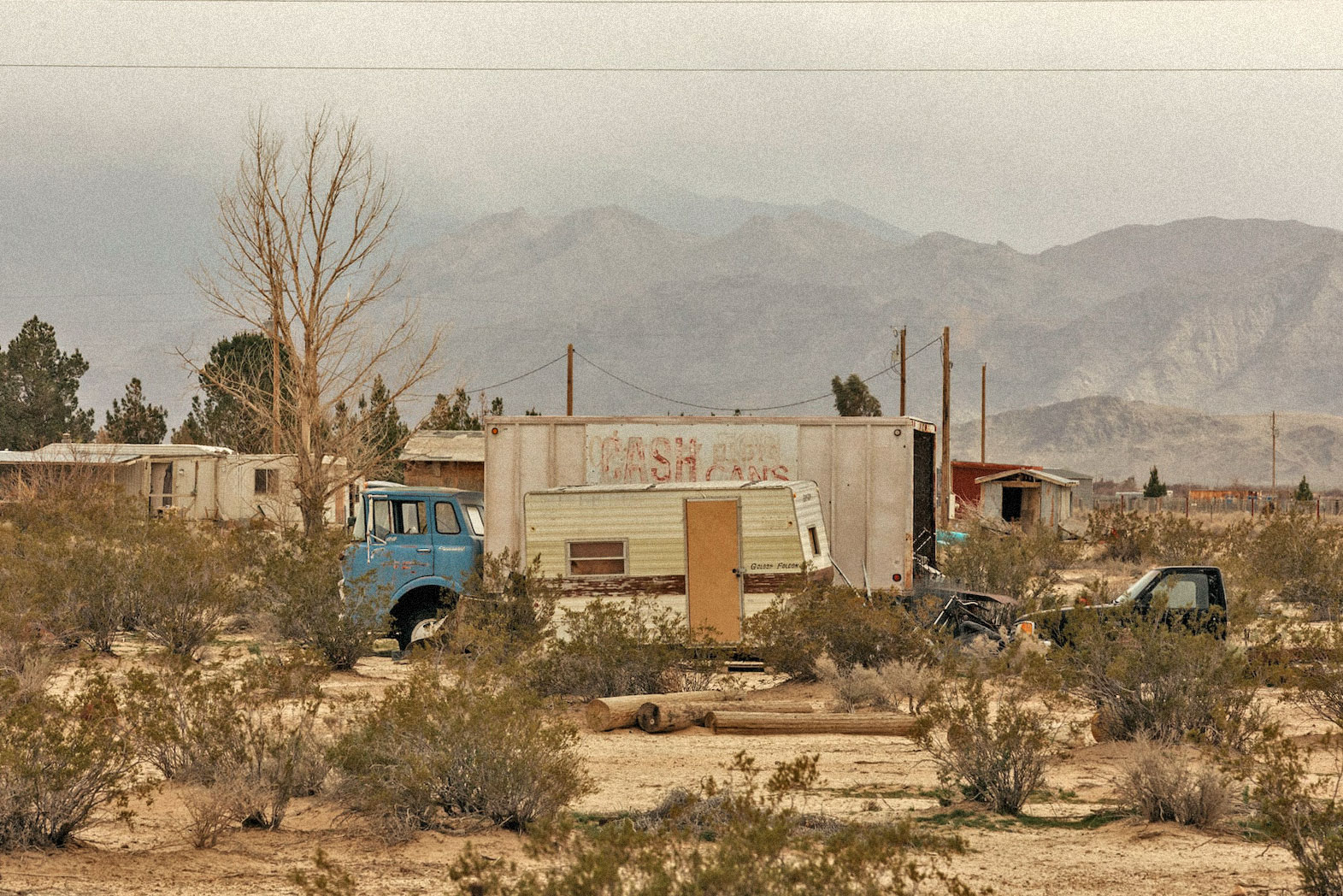

Indeed, Vidler’s loose regard for beneficial-use requirements has sometimes landed the company in hot water. In 1999, Vidler asked Nevada officials for permission to pump around 2,000 acre-feet of groundwater in Sandy Valley, a remote community of trailers and tumbleweeds about an hour southwest of Las Vegas. Vidler claimed to be applying for the water on behalf of a real estate company in Primm, a casino town on the California border. It laid out a far-fetched plan to build a pipeline that would move Sandy Valley’s water down to Primm across 25 miles of mountains, allowing developers to build housing and a theme park. The state government gave Vidler only some of the rights it asked for — but it amounted to almost as much water as the entire town of Sandy Valley used at the time.

A windy day in Sandy Valley, Nevada, a rural community where Vidler tried and failed to export groundwater. Mikayla Whitmore / Grist

When Sandy Valley residents heard about the project, they were furious. The area’s aquifer was already overdrawn thanks to a number of irrigated farms nearby. Residents depended on shallow household wells for their water, and they were terrified that those wells would go dry if the state let Vidler take its share.

“Vidler is a four-letter word here in Sandy Valley,” Al Marquis told me when I visited the town in February. A retired real estate lawyer who sued to stop Vidler on behalf of his town, Marquis is a quintessential Sandy Valley personality: He wears a ten-gallon-hat, flies amateur planes, and writes books of what he calls “cowboy poetry.” He recalled that a Vidler representative who showed up at a public meeting about the application found himself greeted by shouts and death threats from angry residents, who reminded him in no uncertain terms that nearly everyone in the valley owned a firearm.

In 2006, a judge overturned the state government’s decision to grant Vidler’s application, ruling that the company hadn’t proven it could put Sandy Valley’s water to beneficial use. Vidler claimed that the Primm real estate company needed the water to build apartments and a theme park, but the company couldn’t demonstrate that any of that development was really going to happen — the main evidence it had was a one-page wishlist drafted by the real estate company itself. In the absence of a clear beneficial use, the judge wrote, Vidler had no claim to Sandy Valley’s water, and the state had erred in giving the company permission to pump.

“It appears to me that the company was formed for the sole purpose of speculating in and the hoarding of a public resource,” Marquis told Grist. He hypothesized that Vidler never wanted the water for Primm at all, and instead just wanted to flip it to someone else later on. “I gotta give them credit, in that they had foresight.”

Timian-Palmer and her fellow executives saw that the West didn’t have enough water, and they knew that was good news for Vidler: As drought got worse, the company’s assets would only get more valuable.

As the nation’s housing market boomed in the early 2000s, Vidler evolved. Instead of just buying and selling water rights that were already in use, the company began to search for unclaimed groundwater in remote parts of Nevada. It drilled new wells to bring that water to the surface, built new infrastructure to move it toward big cities like Reno and Las Vegas, and marketed it to developers and utilities. If Vidler could sell a new water source for more than it cost to develop and transport the water, the company would turn a profit.

“There seemed to be a void in terms of developing new supplies of water,” said Hart, explaining the opportunity. “Governments don’t really like to spend money for future citizens or future residents, and developers don’t want the upfront risk of having to go out to develop water for projects somewhere down the road.”

At the same time, major water sources like the Colorado River were showing signs of vulnerability as the region entered its current climate-fueled megadrought, lending more urgency to the search for untapped water. It could take years to secure regulatory approval for new groundwater pumping and even longer to build infrastructure to move that water around. Hart and Timian-Palmer were some of the only people in the West with the capital and expertise needed to pursue this kind of project.

The company’s first major experiment was a public-private partnership with a massive rural county about an hour north of Vegas. Lincoln County is one of the most sparsely populated counties in the nation — its population of 4,500 occupies a land area larger than Massachusetts — but it also boasted a hoard of untapped groundwater, most of which no one had ever tried to use. This water sits in some of the state’s shallowest and most remote aquifers, where it has accreted over thousands of years beneath chalk-white valleys.

In the late 1980s, Las Vegas’s powerful water utility filed applications for almost all of Lincoln County’s unused water, more than 100,000 acre-feet in total, and proposed to build a pipeline that could bring it to Sin City. Officials in Lincoln County were still trying to fend off the big city when Vidler showed up and offered to act as a white knight. The company said it would invest millions of dollars to find and pump the county’s groundwater resources while also protecting those resources from Las Vegas. In exchange the company would get half the proceeds from any water the county sold.

Depending on whom you ask, this was either a boon for an impoverished rural county or a corporate takeover of a public resource. Wade Poulsen, the county employee who runs the water partnership, told Grist that Vidler had been “fantastic” and claimed that the county “would be nowhere without them.” But conservationists allege that Vidler was mining Lincoln County’s resources for profit.

“Vidler has turned Lincoln County into a water colony,” said Patrick Donnelly, a conservation biologist with the nonprofit Center for Biological Diversity who has litigated against groundwater usage in Nevada. “They own some serious water up there, and there’s this ideology of, ‘This water exists for us to benefit economically from it.’”

The business thesis for the Lincoln-Vidler partnership was based on the assumption that the growth of Las Vegas would one day extend so far that it crossed the border into Lincoln County, more than 50 miles away from the city’s downtown. In the heady days of the early 2000s housing boom, this seemed like a real possibility; a number of real estate developers had staked out housing projects that could use Lincoln County’s water.

Chief among them was Harvey Whittemore, a friend of the late Senator Harry Reid and powerful casino lobbyist, who agreed to buy 1,000 acre-feet of water rights from Vidler in 2005. Before he went to prison for campaign finance violations in 2014, Whittemore spent more than a decade trying to build a megadevelopment called Coyote Springs in Lincoln County, pitching it as a desert metropolis that would someday contain 160,000 homes.

He managed to build a golf course on the development site, but a regulatory battle subsequently derailed the project and Whittemore never used Vidler’s water. Whittemore’s green, which was designed by golf legend Jack Nicklaus, still stands by itself on an empty desert highway, flanked by a massive sign announcing the future site of Coyote Springs, which another company is still trying to push forward. A tortoise habitat sits just a few feet away.

“They said at first they were gonna provide water for everybody, but the only people that [the Lincoln County partnership] ever actually tried to develop water for were [real estate developers],” said Louis Benezet, a longtime county resident. He said the water district initially discussed agricultural projects and growth opportunities in the county’s small towns, which were more attractive to county residents, but later focused on exporting water toward Vegas.

New homes under construction in Mesquite, Nevada. Grist / Mikayla Whitmore

Future builders in the area will likely need to acquire water rights from Vidler. Grist / Mikayla Whitmore

Timian-Palmer also pursued a similar strategy in fast-growing Reno in the early 2000s, targeting a property called Fish Springs Ranch about an hour north of the city. The land under the ranch contained enough groundwater for thousands of homes, and officials in the Reno area had long eyed it as a water source that could reduce the city’s reliance on the Truckee River, which drains out of Lake Tahoe. Instead of asking the local utility to help with the costs, as past entrepreneurs had, Vidler used private capital to push the project forward. The company built a pipeline that snaked through 28 miles of hilly terrain, ending in a cluster of valleys that were primed for future construction.

It was a transaction only Timian-Palmer could have managed, and one that demonstrated Vidler’s clout on water issues: Getting permission to build the project required conducting multiple federal environmental reviews, placating officials in multiple states, negotiating with the nearby Pyramid Lake Paiute Tribe, and passing a bill to ratify the details in Congress. Even after spending almost $100 million to permit and build the project, Vidler still stood to profit by selling the water to developers in Reno’s suburbs — there were almost no alternative water sources in the valleys north of Reno, so Vidler would be able to set the price.

Alas, Hart and Timian-Palmer had terrible timing. Just as the company’s projects in Reno and Vegas seemed to be taking off, the U.S. housing market started to wobble, led by a wave of foreclosures in Nevada and other Western states. When the market collapsed, builders and developers nixed all their suburban development projects, sold off their land, and pulled out of their agreements to buy water from Vidler. The company had moved heaven and earth to secure water for Nevada’s future growth, but that growth seemed to evaporate overnight.

“When Vidler started construction on the pipeline project, essentially, all of the water was spoken for,” said John Enloe, an official at the water utility that serves the Reno area. Enloe worked with Vidler on the pipeline project. “By the time construction was completed, the Great Recession hit, and everyone backed out. There just wasn’t a need for the water.”

Even as the housing market started to rebound from the Great Recession, Vidler spent much of the next decade running up against a very simple problem: The company had spent millions of dollars to develop new water resources across the West, paying to drill test wells and fill out lengthy water-right applications with the state government, but it couldn’t find buyers for all the new water it had developed.

That was in part because regulators had started to question the logic of growth. By the time the Western real estate market surged back to life in the late 2010s, the megadrought that gripped the region was well into its second decade. Major reservoirs in the Sierra Nevada and the Colorado River were bottoming out, and many rural communities were starting to see their wells go dry. This shortage had begun to stoke new concerns about overreliance on groundwater, and Vidler soon found itself facing new opposition from courts and regulators.

In a sign of its commitment to aiding development, Vidler fought back against these restrictions with a vengeance, litigating and lobbying to ensure its projects could move forward.

A case in New Mexico demonstrated how aggressive the company could be in snapping up water. In the early 2000s, as Vidler was looking to expand into the state, Timian-Palmer connected with a rancher named Rob Gately. Gately owned a large chunk of land in the mountains east of Albuquerque and was seeking to build a big suburban development on the empty parcel. The area was far from prime real estate: It boasted a few dozen houses scattered across a stretch of wind-blown desert, but nothing else in the way of commerce. At least one other proposed development had already fallen through. Even so, Vidler offered to help Gately secure water. It applied to the New Mexico state government for permission to pump 700 acre-feet of water from the area aquifer, spending almost $6 million during the application process.

But Vidler’s own models showed that water use from the new development would cause water levels in the aquifer to drop, endangering residential wells. “People are already having problems with water, and that’s well-known here,” said Joanne Hilton, a hydrologist who lives in the area around the proposed development site and relies on a household well.

By 2017, residents had taken Vidler to court in an attempt to stop the project. Several key executives had to take the stand, including Timian-Palmer and her longtime right-hand man, executive vice president Steve Hartman. During a series of testy depositions, it emerged that Vidler seemed to be stretching the truth about the “beneficial use” it planned for the water. The company claimed that Gately was the mastermind behind the development, but the Montana holding company he was using for the project had been dissolved and no one from Vidler seemed sure about where he was based.

During one deposition, the lawyer for the area residents asked Hartman if he could provide specifics about how Vidler wanted to use the water. Just what kind of development was Gately trying to build, and how much water would it need? Hartman struggled to answer.

“So assuming that you get the permit and the case becomes final, then at that point you and Mr. Gately are going to sit down and talk about what’s next, is that right?” the lawyer asked.

“Yes,” Hartman said.

“And at this point you have no idea what that is?” the lawyer asked.

“I do not,” Hartman replied.

Two years later, the court tossed out Vidler’s application, ruling that the project would have risked taking water away from area residents and would conflict with New Mexico’s statewide goals for water conservation.

Faced with obstacles like these, Vidler had to go on offense. The company donated more than $275,000 to Nevada political candidates between 2008 and 2022, increasing its annual contributions in the years that followed the Great Recession. Hartman became a fixture in the Nevada legislature, lobbying on dozens of water bills, many of them concerned with obscure points of water law. During the present legislative session, as the company prepares to defend its water interests in Lincoln County, it has hired Nevada’s premier lobbying firm, whose other clients include Amazon and Uber.

In recent years, Timian-Palmer and Hartman have tried to scrape value from Vidler’s water assets wherever they can. They sold off some of their banked Arizona water to a golf course in a Phoenix suburb, making a more than threefold profit. They returned to Sandy Valley in 2016 to apply for water on a different patch of land, only to run into trouble once again with Marquis, who discovered that the company hadn’t told an area landowner it was going to apply for the water under his land. In litigation over the Coyote Springs development in Lincoln County, they conducted geological testing to prove that they should be able to tap an aquifer the state had deemed too vulnerable, alleging the existence of an underground fault they named “Dorothy’s Fault,” apparently after Timian-Palmer. They even went so far as to demand that Nevada cut off water deliveries to a town near a basin where Vidler had been prevented from pumping water, arguing that the town shouldn’t get to use water, either.

“They’re engaging in these processes for one reason and one reason only, and that’s to one day make money,” said Roerink, the water conservation advocate.

Neither Vidler nor D.R. Horton responded to extensive requests for comment on this story. Dorothy Timian-Palmer initially agreed to an interview in response to a request from Grist, but a Horton spokesperson later said that the company wouldn’t be participating in the story. After Grist visited Vidler’s office in Carson City, a Horton spokesperson offered to respond to a list of questions, but company representatives failed to do so before publication.

Even as Vidler sought buyers for its water rights, PICO went through a shakeup: Shareholders grew dissatisfied with Hart’s high salary and with the slow return on their investments. They ousted Hart and replaced him with a new chairman who soon cut costs, selling off PICO subsidiaries. Vidler’s assets were more difficult to cash out: The company had spent tens of millions of dollars on water projects like the ones near Reno and Albuquerque, and it wasn’t clear when those projects would start making money. The easiest way to make the company’s shareholders whole was for another company to buy Vidler outright.

Timian-Palmer and her fellow executives started trying to find a buyer as early as 2017, when they hired a bank to solicit potential offers, according to a corporate filing. The bank contacted more than 150 different potential buyers, but none of them showed much interest. The main problem was that nobody seemed to be interested in acquiring Vidler wholesale. As the search continued, it became clear that Vidler needed a company that wanted to use its executives’ water expertise, not just sell off the assets Timian-Palmer had acquired — in other words, a company that needed Vidler as much as Vidler needed it.

It took a few more years and a millennium-scale drought, but in the final months of 2021, Vidler found a company that could finally make its development dreams a reality.

D.R. Horton is a tight-lipped company, and it didn’t say much about its purchase of Vidler. In a press release published on the day of the acquisition, the company noted that “Vidler owns a portfolio of premium water rights and other water-related assets … in markets where D.R. Horton operates.” A few weeks later, when a stock analyst asked about the purchase on an earnings call, an executive replied that “we put out pretty much what we’re going to say about Vidler in the press release.”

Even so, the logic of the transaction was apparent: The places where Vidler owned substantial water rights were also places where Horton was building homes. At a shareholder meeting in 2021, Timian-Palmer told investors that Horton was “moving like gangbusters” in the north suburbs of Reno, planning multiple subdivisions that could purchase water from Vidler’s long-dormant Fish Springs Ranch pipeline. The valleys north of Reno are now home to a horde of uniform subdivisions, most of them sandwiched against each other just off the freeway. Many of the largest belong to Horton. If the city’s recent growth spurt continues, Vidler’s pipeline will be the only available water source for future builders.

Horton is also building several developments east of Carson City on a fast-growing industrial corridor near a Tesla factory. In a 2021 financial statement, Vidler noted that “there are currently few existing sustainable water sources to support future growth and development” in that corridor, except for Vidler’s own supplies. Horton also has numerous active projects in central Arizona, where Vidler has banked almost 300,000 acre-feet of water underground. Together, the two companies have everything they need to capitalize on the West’s post-pandemic population boom.

Vidler has always operated more like a fixer than a financial trader, not just flipping assets but developing new water resources in the driest areas. Several sources who spoke to Grist theorized that this was why Horton paid so much to acquire the company.

“If you’re a homebuilder, your best option is to do what Horton has done — go out and find more supply,” said Grady Gammage, a real estate lawyer who has represented Greenstone, another water broker founded by a former Vidler employee, and several homebuilders. “What Horton is likely thinking is that you’re faced either with doing a deal [to get new water], or trying to build that expertise in-house.”

The future of the West depends on whether, and to what extent, these companies can secure these deals and expertise in the face of new regulatory restrictions and supply constraints.

Nowhere is this dynamic clearer than in the western suburbs of Phoenix, where developers and builders have thrown up tens of thousands of homes that rely on groundwater from fragile aquifers. Earlier this year, Arizona’s new governor released a study that showed the area has much less water available than was previously thought. State law requires developers to show that proposed homes have a hundred-year water supply, and officials have now decreed that there isn’t enough groundwater in the area to provide for any more new subdivisions in the southern and western outskirts of the city.

This has left several gigantic development projects stuck in limbo, including ones with which Horton was involved. It has also forced developers and homebuilders to look for alternate sources of water, including from underground storage facilities like Vidler’s. The company’s biggest underground aquifer contains enough water to supply about 2,000 homes for a hundred years each.

“It’s a challenge to find other supplies right now, to say the least,” said Spencer Kamps, vice president of legislative affairs at the Central Arizona Home Builders Association, which advocates for builders and real estate. “A number of investments have been made out in the area under the assumption that there was water available for growth.” But many people in the industry now worry that those assumptions were mistaken.

You wouldn’t know it from visiting the area. Earlier this year, I presented myself as a potential home buyer in the Phoenix suburbs where the state has identified a groundwater shortage, touring several Horton developments. These developments are tight clusters of cookie-cutter homes, surrounded for the most part by empty desert or isolated alfalfa fields. Construction appears to happen rapidly: As I drove through the developments, I found myself slipping back and forth between streets full of finished homes with xeriscaped lawns and streets where construction crews were still hammering at open timber frames.

In speaking with Horton sales representatives on my tours, I asked about water access, saying I’d heard there were issues in the area. The representatives brushed off my concerns, saying they “try to stay out of politics,” or that they “don’t believe they would allow growth out here” if there wasn’t enough water.

That is far from certain. Timian-Palmer and her colleagues have spent decades finding water sources for suburban developments like these. While the homes they helped build will last for many decades, the water that supplies them may not. Without ample rain to replenish them, the small and fragile aquifers that Vidler has tapped could someday empty out, leaving future homeowners high and dry. This has already started to happen in rural parts of the West where agriculture is dominant, and it may ultimately happen to the suburban developments Vidler is now helping to build.

Mike Machado, a former California state senator who served on PICO’s board of directors between 2013 and 2017, said the company’s business model makes him worried for the future of those developments.

“The biggest challenge for Vidler is whether or not the resources they have are renewable,” he told Grist. “It’s great to be able to have these resources, but if all you’re doing is mining them, at some point in time, you’re not going to have them. So that is creating a false sense of security for those that are relying on the resource.”

Horton’s sales representatives in Arizona have no such misgivings. For the moment, at least, the building boom is very much alive.

“If we continue to grow out here, the people living here will have water,” one sales representative told me. “What, are we just not gonna have water when we turn our faucet on?”

Correction: An earlier version of this article incorrectly referred to Patrick Donnelly of the Center for Biological Diversity as an attorney.