Making this into gas doesn’t make much sense for Indiana.

The state of Indiana appears to have made a pretty bad deal.

Last year, it signed an agreement with Indiana Gasification LLC, a subsidiary of Leucadia National, to buy gasified coal for the next 30 years. Coal gas is exactly what it sounds like: a combustible gas created from coal. And for the privilege of using it, Indiana natural-gas customers could shell out an extra $1.1 billion over eight years.

From the Indianapolis Star:

All residential ratepayers — regardless of their provider — would see their monthly gas bills increase an average of about $3.90 during that period, according to estimates from Vectren Corp., a critic of the coal gasification plant. That’s about $375 per ratepayer over eight years.

The plant’s developer, Leucadia National Corp., called Vectren’s estimates “absurd,” and Gov. Mitch Daniels said through a spokeswoman that he continues to support the project.

But independent energy industry analysts agree with Vectren. Under the terms of a deal orchestrated by the Daniels administration, ratepayers will almost certainly end up subsidizing the plant for five to 10 years, they say.

The rate homeowners will pay over eight years pales compared to small businesses — $2,000 — and small industrial facilities — $250,000.

A few years ago, a coal gasification deal made more sense.

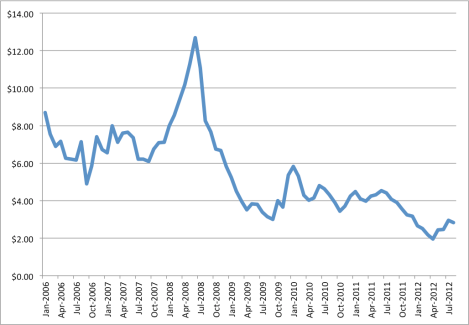

Under the deal, the state would purchase the gas for an average of $6.60 per million British thermal units in 2008 dollars over the life of the 30-year contract. That arrangement might have made sense six years ago when the plant was first contemplated, industry analysts say. Natural gas was trading at more than $10 per million British thermal units [BTUs].

Since 2006, here’s what spot prices of natural gas have done.

EIASpot price of natural gas in dollars per million BTUs.

That whistling sound you hear is a price falling, rapidly. The massive supply boost from the fracking boom has meant that natural gas is eating coal’s lunch in energy generation.

Indiana Gasification assures everyone that there’s nothing to worry about.

[Project director Mark] Lubbers said the debate about Vectren’s “absurd” estimates ignores other factors, such as Indiana Gasification’s commitment to cover up to $150 million of any losses. The company also “guarantees” $100 million in savings by the end of the 30 years, Lubbers said.

If those savings aren’t realized, Indiana Gasification can cover the shortfall in cash or extend its contract with the state at a lower price. Absent those two things, the state could force a sale of the plant to make up the difference.

In other words, if ratepayers do end up subsidizing the facility, they might get their money back in, oh, 2040 or so.

And here we thought this was a lousy deal.