Renewable energy is attracting the attention of serious investors, but “the world still lacks a widely-agreed methodology for comparing renewable energy projects with each other, and with fossil fuels.” So says Bloomberg New Energy Finance (BNEF) in an interesting new white paper.

Why are such comparisons so difficult? Think of it this way. When it comes to both fossil fuels and renewable energy, there is a resource — a store of potential energy out there in nature — that must be harvested and converted to usable energy.

Fossil fuels are expensive to harvest, what with all the land to buy, rocks to mine, and fuel to transport, but relatively cheap to convert into energy once you’ve got them, because they are extremely energy-dense.

For renewable energy, it’s roughly the opposite. The resource is mostly free and virtually limitless. Sun, wind, moving water, biomass, they are all in plentiful supply. But converting them into energy is expensive, because they are extremely energy-diffuse.

This fundamental difference makes it difficult to assess the total resources and potential of each, across different sources and technologies.

Let’s take a quick detour to familiarize ourselves with the measurements and vocabulary used to assess the value of fossil fuels. They are expressed in terms of reserves. Here’s a good primer on the various flavors:

Oil and gas companies may publish three kinds of reserve estimates: proven, probable, and possible, though the latter category is rare, as it implies only about a 10% chance that the minerals are actually present. Reserves are “proven” by a combination of enough test wells and seismic surveys to indicate around a 90% probability that they exist; “probable” reserves are established by wider-spaced test wells and should have at least a 50% chance of being present. … The reserves information permits investors to calculate useful figures, such as reserve life (proven reserves divided by the most recent year’s output) and proven reserves per share of common stock.

That’s all pretty standard and well-established. Now there is an attempt underway to develop the concept of “renewable reserves” as a way to enable a direct comparison. It’s run by an outfit called the Renewable Reserves Initiative, which is composed of industry stakeholders.

While that’s brewing, BP commissioned BNEF to run a kind of proof of concept, applying the renewable-reserves construct to a few specific sectors in specific countries.

In case you find the concept puzzling, BNEF explains:

While on a resource level renewable energy sources themselves are infinitely replenished and thus quite different from finite geological energy sources, at a project level it is possible to consider a renewable project as representing a future cumulative energy output. This output is not infinite, but bounded by technological and economic constraints in a way that has significant parallels with fossil energy projects. By considering a project’s commercial status within these constraints, it is possible to evaluate the cumulative energy output over its lifetime, and to classify this output as a reserve. In this way, different energy sources can be compared more easily, and renewable energy’s contribution can be more directly compared to that of fossil fuels.

So the idea is to compare the “future cumulative energy output” of current and planned renewable projects to the proven reserves of coal, oil, and gas.

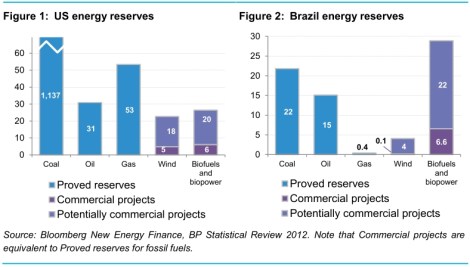

For this report, BNEF assessed two sectors, wind and bioenergy, in two countries, the U.S. and Brazil. Here’s the short version of what it found:

(There’s tons of info in the report on how units of energy are converted into a common metric and other technical details that nerds like me find fascinating.)

Here’s the takeaway, from BNEF’s executive summary:

Renewable energy from existing projects, when seen through this frame, is perhaps larger than expected. In the US, thanks in part to high rates of wind and biofuels deployment, the ‘commercial’ renewable reserves of these two sectors are about one seventh the size of the equivalent combined oil and gas reserves (note that bioenergy reserves include biomass and waste-to-energy sources). In Brazil, bioenergy is particularly strong, again because of biofuels, and represents reserves equivalent to over two fifths of the country’s Proved oil and gas reserves. The Brazilian wind sector, though small today, is expecting rapid capacity growth in coming years, shown by the large reserves attributed to ‘potentially commercial’ projects.

So yeah, not bad for those two sectors — still relatively small compared to oil, gas, and coal reserves, but it’s still early in the game for renewables. This suggests that renewable reserves may catch up to oil and gas faster than anyone thought.

Now, a caveat. The comparison here is renewable reserves — including projects that are up and running alongside planned projects — with proven oil and gas reserves. That’s not exactly a fair comparison. If the oil and gas side were expanded to include probable reserves, it would look much, much bigger. And if the renewables side were restricted to actually existing projects, it would look much, much smaller.

BNEF is extremely clear that this is preliminary work, a first attempt to put this construct to use. Lots of work remains to be done refining and sharpening it. It’ll be interesting to watch.

Before I finish, just one conceptual point: Notice that fossil fuel reserves and renewable reserves are different in one crucial way. Fossil fuel reserves are finite and declining. Technological advances may enable us to move more from the “possible” to the “proven” category, bumping up the numbers temporarily — that’s what has happened with the revolution in fracking — but the long-term trend is, inevitably, downward. The structure of the situation is, the more we dig up, the less there is, and the more expensive the rest is.

Renewable reserves are the opposite: We are steadily increasing them. Each time we build a new wind farm or put up a solar panel, the total renewable energy available increases. And what’s more, the more we build, the cheaper it gets to build more (economies of scale bring price declines).

So this is the coolest thing about being able to compare the two directly: We can watch as the fossil fuel line goes down and the renewables line goes up. Some day — hopefully in my lifetime — they will cross.