Shaun Meehan was burned out. It had been about a year and a half since he left his job at an aerospace company to found a clean energy startup in San Francisco with three of his friends, but the path to success he’d once envisioned had crumbled. Sitting in their tiny conference room, nicknamed the “Pineapple Room” for a tropical rug that covered the floor, in the summer of 2019, he and his co-founders faced their primary investor to deliver a grim update.

For a while things had been looking up for Charm Industrial. The friends, all engineers by training, had designed a machine that could turn agricultural waste, like almond shells, into renewable hydrogen fuel. They’d even found a partner, the owner of a fueling station for hydrogen-powered cars, who wanted them to build a pilot plant at his facility. But the process of leaving the lab and entering the real world suddenly lifted the veil on all the economic, regulatory, and logistical challenges the startup had yet to solve.

Meehan had lost confidence that Charm could deliver on a large scale. It felt like their boat was leaking. And in that moment of doubt, he nearly blew everything up.

“I was just like, ‘I don’t know if I would invest in Charm,’” he recalls telling their investor that day. “I was looking at the data, I was looking at the economics of trucking, I was looking at the economics of moving the hydrogen, and I was like, this doesn’t close.”

But the investor was undeterred. “I’m investing in the team — I’m investing in the ability for you guys to figure it out,” Meehan said the venture capitalist told them. It’s a sentiment that Meehan has since learned is common in cleantech finance.

About six months later, Charm landed its first major deal. They had figured it out — but what they figured out had nothing to do with hydrogen.

Meehan and his friends were pitching a new idea. Charm would use the same technology, but instead of turning plants into a useful energy product, it would offer a service. The company would take those almond shells and other types of biomass, convert them into a carbon-rich oil, and inject the oil deep underground.

Strange as it may sound, demand for this service — a form of what’s called “carbon removal” — was just beginning to grow. And in less than a year, Charm went from a struggling alternative fuel startup to one of the most credible carbon removal companies on the market.

To prevent the most devastating effects of climate change, it’s essential to cut greenhouse gas emissions by phasing out fossil fuel use. But even if the world aggressively electrifies cars and buildings and generates enough clean energy to power them all, experts say there are likely to be residual emissions from activities that are harder to decarbonize, such as farming, aviation, and chemical production.

That’s where carbon removal comes in.

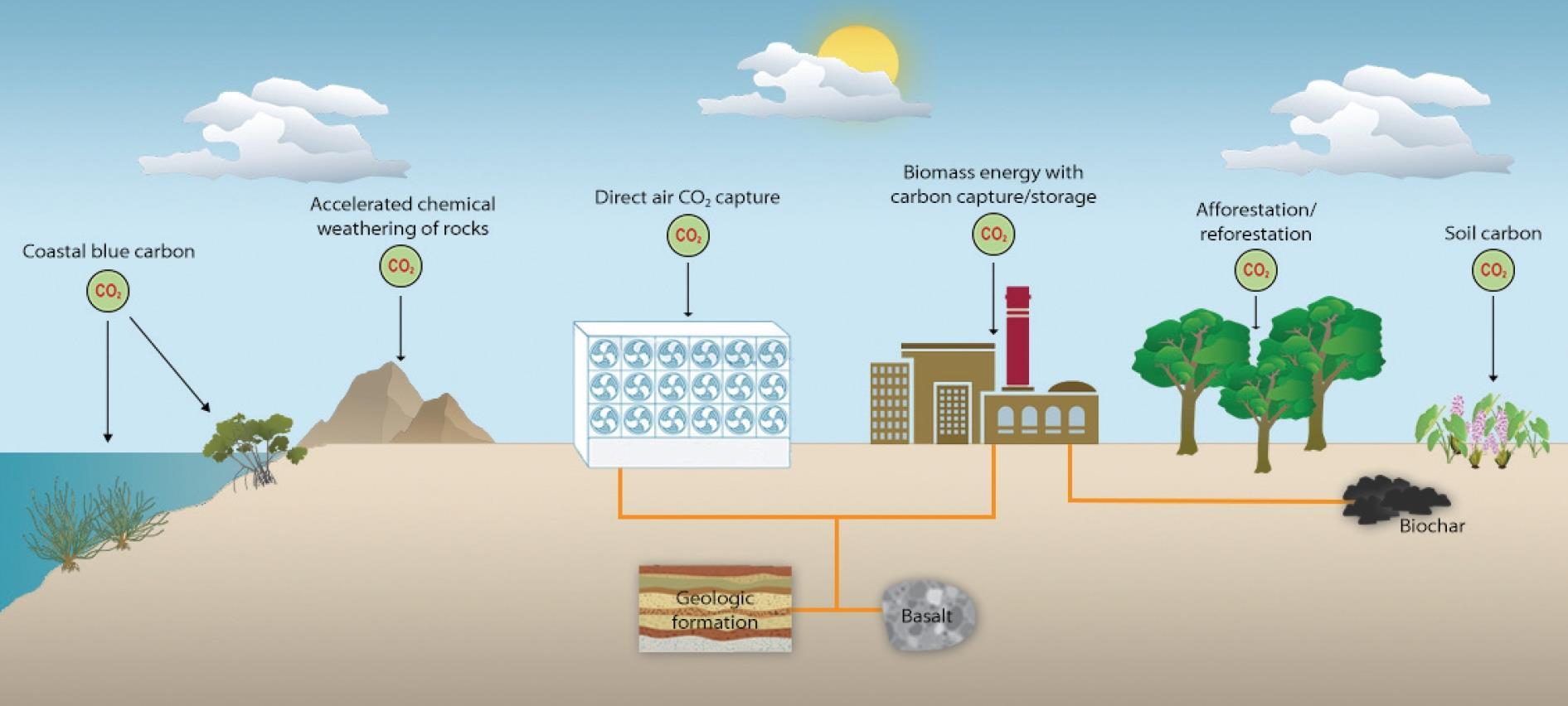

The term refers to actively pulling carbon dioxide out of the atmosphere and storing it in soils, plants, rocks, and within the Earth’s crust. Compensating for those hardest-to-eliminate emissions with carbon removal could help bring warming to a halt before it becomes much more dangerous.

This balancing act between lowering emissions and removing carbon is usually described as achieving “net-zero.” But scientists also envision versions of the future where, on a planetary scale, we’re able to draw more carbon out of the atmosphere than we emit, achieving “net-negative” emissions to lower global average temperatures to safer levels. Additionally, some international climate experts have argued that wealthy countries like the U.S., which is responsible for more of the CO2 that’s in the atmosphere today than any other country, should aim for net-negative emissions across their economies as soon as possible, allowing poorer nations to reduce their emissions more slowly.

There are, however, enormous obstacles to removing enough carbon from the atmosphere to make a dent in any of these goals. Earth is rich with existing carbon “sinks” that already draw down CO2, like forests, soils, and wetlands. The potential to expand them is limited by demand for land; the risk of fire, pests, deforestation, and other disturbances; and a lack of robust standards for measuring and monitoring the CO2 they remove. Engineering approaches that scrub CO2 directly from the air and pump it underground are currently energy-intensive and wildly expensive.

With the mercury on the globe’s thermometer inching ever upwards, these challenges are emerging from the shadows of scientific journals and entering the mainstream. Big Tech, in looking to reduce its carbon footprint, has begun thumbing its nose at traditional carbon offsets. Instead, companies like Microsoft and Amazon are opening up their wallets to fund the most promising carbon removal solutions. “The world must build a carbon removal market on an unprecedented scale and timeline, from nearly scratch,” Microsoft wrote in its 2020 environmental sustainability report. By investing in early-stage solutions, Microsoft and its peers say that they hope to make more reliable and affordable options available down the road.

So when Charm began marketing its strange plan to bury plant oil in March of last year, it was entering a mostly barren landscape, with money up for grabs, and offering something few of its competitors could: the promise of removing carbon permanently, reliably, and potentially on a grand scale.

Before it was a hydrogen business, or an oil business, or really a business at all, Charm was an idea for an art project. One of the company’s founders, Kevin Meissner, wanted to build a shrine of sorts to human-induced climate change.

Meissner had worked in the aerospace industry for six years but no longer felt there were impactful problems left to solve in that space. He became interested in carbon removal, which he felt was a societally important but underdeveloped technology. To him, plants seemed like the best place to start, since they’re cheap and suck up carbon dioxide all on their own through photosynthesis. So he began looking into converting plants into something called biochar, a charcoal-like substance made by heating organic material in an environment without oxygen. Studies have shown that biochar can potentially sequester carbon for hundreds of years.

The big question for Meissner was what to do with the biochar he made. He dreamed up an idea for an art installation that would make the intangible idea of climate change more tangible for people. For example, it might contain a chunk of biochar equivalent to the amount of CO2 released into the atmosphere by taking a cross-country flight.

“I think that building a monument to climate change in the form of some temple that memorializes humanity’s past sins of polluting would be really poignant,” said Meissner.

Meanwhile, Meissner’s friend Peter Reinhardt had also become interested in carbon removal. Reinhardt is the co-founder and CEO of a startup called Segment, which helps companies manage customer data, and was looking for a way to offset his company’s emissions. Meissner and Reinhardt teamed up in 2017 and began exploring different ideas for a carbon removal business, like burying biochar in old coal mines or selling it as a soil additive to farmers, since research has shown it has the potential to improve soil fertility and water retention. They came up with the name Charm as a portmanteau of “char” and “farm.”

But after about a year’s worth of Saturdays spent researching, Meissner and Reinhardt couldn’t quite figure out a business model for the char. Instead, they decided to focus on producing hydrogen. The pivot wasn’t as drastic as it sounds. Biochar is made through a process called “pyrolysis,” a chemical reaction that also produces byproducts like hydrogen gas and a substance called “bio-oil.” Depending on how slowly or quickly the biomass is heated, and to what temperature, it’s possible to fine-tune the results to get more or less char, gas, or oil.

Hydrogen is mainly used in refineries and to make fertilizer, but there’s a growing market for hydrogen-powered vehicles, and experts say it could eventually be used as a climate-friendly fuel for power plants and industrial facilities. That’s because hydrogen doesn’t release any greenhouse gases when it’s burned. However, today hydrogen is responsible for about 2 percent of global CO2 emissions, because most of it is made from gas and coal. Producing hydrogen from plants cuts those fossil fuels and their emissions out of the picture.

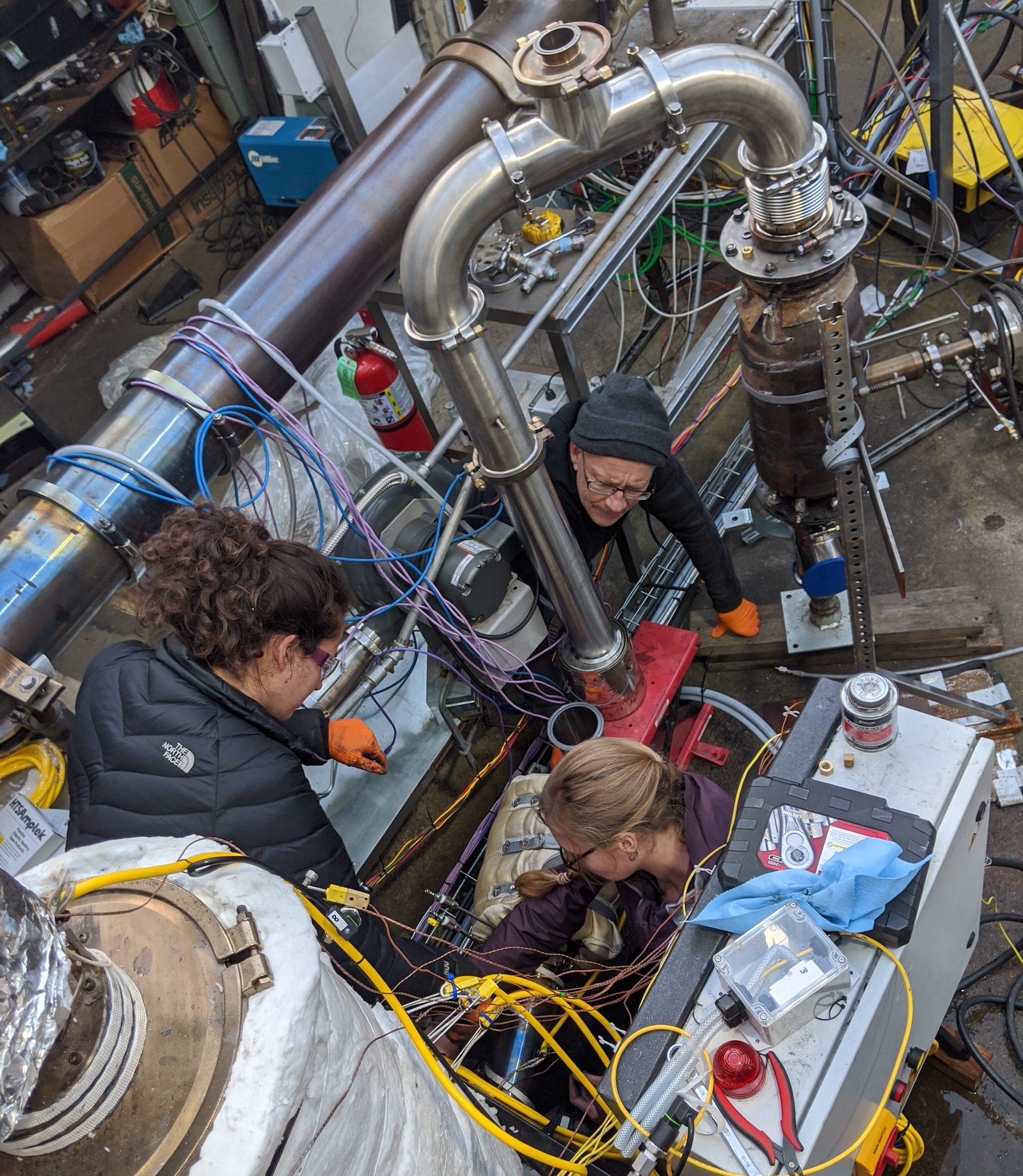

Meissner and Reinhardt officially formed Charm Industrial in February 2018. They brought in Meehan and another friend, Kelly Hering, both of whom Meissner had worked with previously at the satellite imaging company Planet Labs, as co-founders. Then the team got to work building the hydrogen plant in the yard of a coworking space before later moving their headquarters to an industrial area on the San Francisco waterfront.

Charm’s ambition was to build a machine small enough to be assembled at existing facilities that would use the gas — about the size of a 20-foot shipping container. While the pathway to turn biomass into hydrogen is well-studied and proven, there were a number of problems to solve in making it work at a demonstration scale. They had to design a custom reactor as well as a hopper to feed unwieldy bits of plant matter into the machine.

The startup made progress on the technology side of things, but when it came to logistics, they started hitting wall after wall. The economics of trucking farm waste to their reactor or delivering hydrogen to potential customers just didn’t make sense. That’s when Meehan tried to talk Charm’s primary investor out of giving the company more money.

But in the back of his mind, Meehan had an idea that might pencil out more favorably. He wanted to try splitting Charm’s machine into two modular devices. One would be placed directly on the side of a farm and be tuned to maximize the production of bio-oil, which can be transported in regular oil tanker trucks — a cheaper proposition than hauling around farm waste. The second machine Meehan likened to a “tiny refinery” that would reform the oil into hydrogen or other useful gases. It could be parked anywhere the gases might get used, like at a fueling station or an industrial plant.

In early 2020, things started to change at Charm. Meehan was researching splitting the machine. Meissner left the company. And Reinhardt, now serving as CEO of both Segment and Charm, saw an intriguing request for proposals posted on the blog of another startup called Stripe, which sells online payment software. Stripe had pledged to spend at least $1 million on carbon removal per year, purchasing it at any price point in order to help the field mature.

Meehan realized that the bio-oil, which is about 43 percent carbon by weight, would meet Stripe’s requirements if they injected some of it underground instead of reforming it into hydrogen. He had already done some research on injecting the oil into waste disposal wells, in case the company ever ended up with extra bio-oil they needed to get rid of.

“Charm’s mission is to reduce global CO2 levels,” Meehan said about the quick pivot to focusing on bio-oil. “So we’re not tied to any technology or any process.”

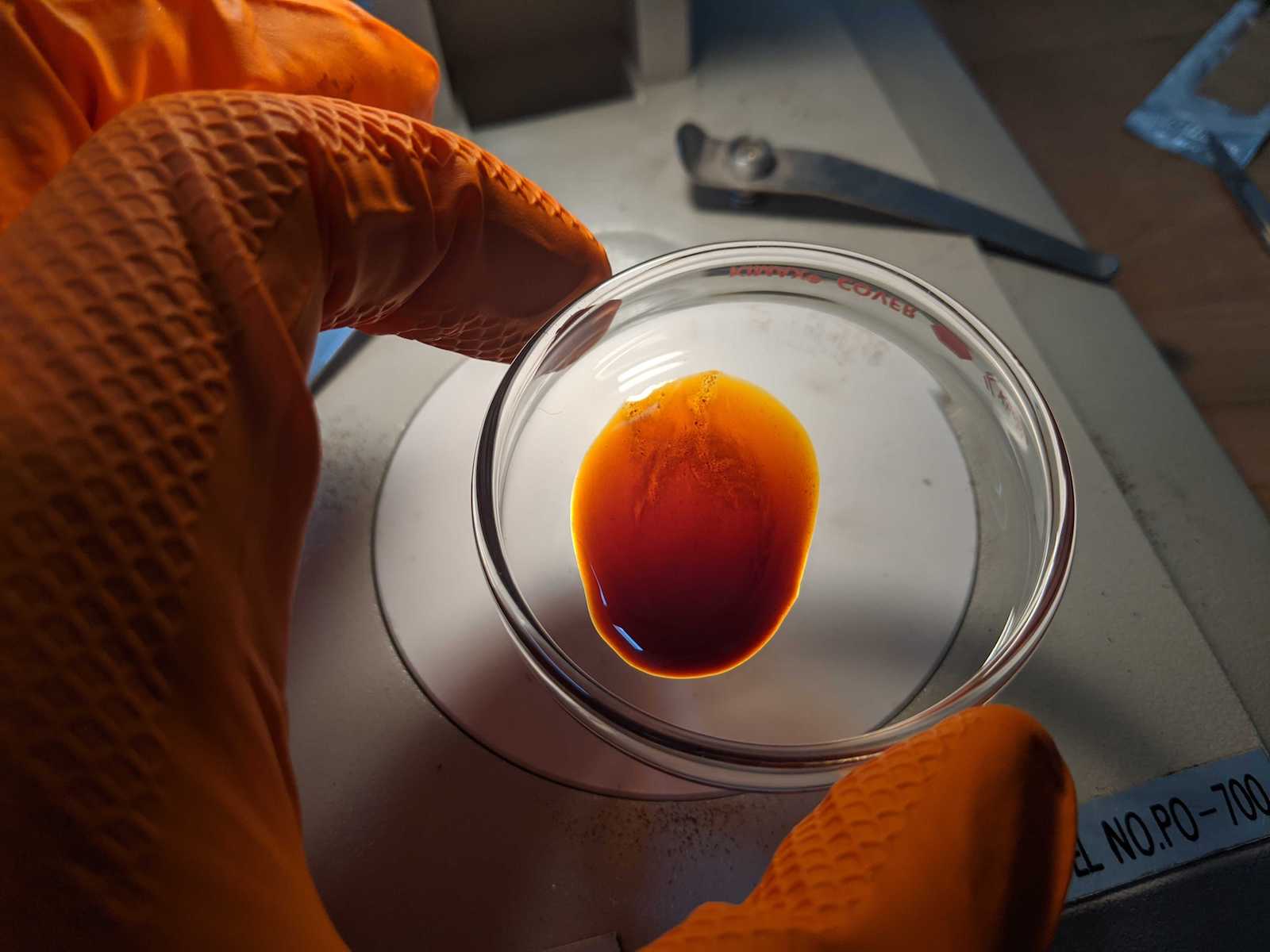

Bio-oil is thick and black and resembles crude oil, lending a certain romance to the idea of injecting it back into the earth, like running the fossil fuel industry in reverse. “We’re putting oil back into the same formations that held it for hundreds of millions of years,” Meehan said.

Despite resembling crude oil, bio-oil isn’t very useful when burned directly. It has a low energy content and a tendency to harden over time. But that latter quality makes it perfect for storing carbon underground. Meehan said that after being injected, the oil will slowly solidify, leaving little danger of it being released back into the atmosphere. The bio-oil Charm could produce would be cheaper to inject than CO2 gas captured from the air or from a power plant, since CO2 has to be compressed into a form that can be pumped underground.

Stripe was sold. After a rigorous review of 24 carbon removal proposals, and input from a panel of outside scientists, Stripe selected Charm as one of only four “high potential” projects it would fund. It paid Charm for 416 metric tons of carbon removal — about the amount produced by two railcars worth of coal — at $600 per metric ton, so roughly $250,000 total.

“We went from concept to customer in like, a few weeks, which was just wild,” Meehan said. “Had it not been for that I don’t think we would be pursuing it as a company.”

Things started moving fast. Other companies began to follow Stripe’s lead. Charm took its bio-oil concept and went on to win more competitive contracts. Shopify, an e-commerce platform, purchased carbon removal from Charm last September.* In January, after an extensive review of 189 proposals, Microsoft bought 2,000 metric tons of carbon removal from Charm. In a white paper justifying Microsoft’s purchases, the company identified Charm as one of only two proposals that proved they could reliably store carbon removed from the atmosphere for more than a thousand years.

Charm Industrial was now officially a carbon removal company.

The seriousness with which companies like Stripe and Microsoft approached making investments to reduce their carbon footprints was, in part, a deliberate rebuff of traditional carbon offsets. Rigorous scientific reviews and white papers are not exactly standard practice.

Most offsets that companies buy are designed to reduce emissions. For example, companies can pay to build a solar farm that replaces fossil fuel generation. They can pay to destroy methane leaking from a landfill. Or they can pay to protect a forest from logging.

However, there’s a catch: Those investments only work to offset a company’s continued pollution if they’re paying for something that never would have happened otherwise. If a renewable energy mandate, pollution regulations, or a conservation program would have spurred the project regardless of the offset market, then the company buying the offset has not really accomplished any emissions reductions. And carbon offsets have a long and well-documented history of overestimating the carbon benefits they claim to deliver.

“In our view, traditional offsets are not a high-leverage way to spend our dollars,” Nan Ransohoff, head of climate at Stripe, told Grist in an email. “They are at best low-leverage climate solutions, and at worst, drive no climate impact.”

Hype is building around using carbon removal to compensate for emissions instead of traditional offsets, partly because carbon removal is less speculative. The benefits of a project that is strictly intended to suck carbon from the atmosphere and store it somewhere are easier to grasp. Or at least, that’s the idea.

But the success of Charm — which had never even tested its plan to put bio-oil underground before being declared one of the most promising companies out there — shows just how hard it is right now to find carbon removal projects that stand up to scrutiny.

Carbonplan, a nonprofit that assesses the integrity of carbon removal projects, analyzed all of the proposals submitted to both Stripe and Microsoft. It found that most applicants did not disclose enough information to fully validate their claims. Methods were vague, volumes of CO2 removed were calculated in a number of different ways, and it was hard to tell how much carbon removal a particular effort had already sold or promised to other buyers.

“Without stronger disclosures, it’s almost impossible for companies — or the public — to know with confidence whether these activities are working,” Carbonplan wrote in a recent blog post regarding the applications submitted to Microsoft.

Charm’s proposal wasn’t bulletproof, either. For example, Charm is using agricultural waste, which brings up questions about how carbon-intensive the farming methods that produced it were. “That’s a big complex world, and, I think they, by design, haven’t opened up all of those questions,” said Danny Cullenward, Carbonplan’s policy director. Meehan said that since Charm doesn’t grow its own biomass, it doesn’t incorporate farming methods into its analysis of net carbon removal.

But within the larger context of proposals, Charm stood out for doing something more durable. Most other projects involved storing carbon in trees and soils, which could easily send CO2 back to the atmosphere in a wildfire blaze or a bout of disease. Ryan Orbuch, a member of Stripe’s climate team, told Grist they believe that Charm will be able to store carbon for more than a thousand years by injecting it underground — on par with how long CO2 lingers in the atmosphere.

Charm’s process was also more tangible, Cullenward said. Other proposals relied on currently difficult-to-validate scenarios, like forest management projects that claimed to increase existing trees’ capacity to store carbon. Whereas these forest management projects relied on a set of assumptions and calculations, Charm could demonstrate to potential buyers what it would do.

There are other ways society could scale up carbon removal besides selling it as an offset, but as long as that’s the model, it’s essential that these methods are measured transparently and accurately. Even assuming an ideal world where carbon removal is purchased solely to offset the hardest-to-eliminate emissions, there’s little room for error. If offsets aren’t achieving what they claim, or they’re going up in flames, total emissions will keep going up.

Charm proved its process was durable, measurable, and would certainly not occur unless someone were paying them to do it. But what Charm is doing also raises a more fundamental question about how to define carbon removal.

In some cases, the line between so-called “avoided emissions” and carbon removal is clear. Technology that captures carbon from the smokestack of a power plant and buries it underground avoids unleashing new CO2 into the atmosphere. Direct air capture technology that scrubs carbon dioxide directly from the air, on the other hand, sucks up carbon that’s already been emitted. When paired with CO2 sequestration, direct air capture offers carbon removal.

But Charm’s process blurs the line, according to Andrew Bergman, an applied physics doctoral student at Harvard University and one of the authors of a primer on carbon removal. Bergman told Grist he doesn’t consider what Charm is doing to be carbon removal, since by making use of agricultural waste that would have normally been burned or left to decompose, it is helping to “avoid” emissions from agriculture. To Bergman, Charm’s process would only be considered carbon removal if the company used crops grown specifically for bio-oil sequestration.

Daniel Sanchez, an engineer and energy systems analyst who runs the Carbon Removal Lab at the University of California, Berkeley, agreed that Charm’s use of farm waste for bio-oil sequestration reduces agricultural emissions. However, Sanchez still considers the process to be carbon removal, since the plants physically remove carbon from the atmosphere, and Charm’s process makes some of that removal permanent. Plus, using plant waste for the process can be seen as a benefit, since it doesn’t create more competition for land.

Meehan said this is how Charm sees it — they’re taking CO2 that normally cycles between plants and the atmosphere and permanently removing it from that loop.

This debate may sound nitpicky, but for Bergman, there is a lot at stake: By allowing a company like Charm to profit by disposing of farmers’ waste, it creates a system that disincentivizes efforts to reduce agricultural emissions in the first place.

“If we package avoided agricultural emissions from waste biomass, which we should be mitigating, as ‘carbon removal,’ we’ll run into the same kind of issue we have with offsets that were going to be conserved anyway,” Bergman said. He was referring to research showing that many carbon offset credits for forest conservation were sold under false pretenses — the forests were never at risk of being logged. “In aggregate over time, we’ll be enabling the claiming of carbon removal credits that shouldn’t be allowed to exist, and those credits will permit more emissions.”

In one sense, it doesn’t necessarily matter today whether Charm is Bergman’s purist vision of carbon removal or not, as long as it’s reliable and long-lasting. “Up until the point that you are removing more than you are emitting,” Sanchez said, “the atmosphere sees no difference between carbon removal and avoided emissions.”

But even if the atmosphere sees no difference between carbon removal and avoided emissions yet, the Earth does. Carbon removal will be resource-intensive, requiring either land to grow trees and other plants, or energy, water, and minerals to scrub CO2 from the air and pump it underground. Leaning too heavily on it, rather than cutting emissions, risks stretching those resources dangerously thin, or failing entirely — and allowing for climate disaster.

The vast majority of startups fail, and there’s no guarantee Charm will make it. The processes underlying its business — producing bio-oil through pyrolysis, drilling wells, and underground injection — are all well understood. Once again, it’s the economics and logistics of scaling up that remain open questions.

Today, Charm’s solution is expensive — about as expensive as capturing CO2 from ambient air. But Stripe told Grist the company clearly showed potential to bring its costs down.

Meehan said Charm’s ultimate goal is to get its price down from $600 to $50 per metric ton of CO2 removed. The company’s grand scheme for getting there is primarily to scale up — as demand grows and Charm produces more bio-oil, it can bring down the cost of manufacturing the equipment and the overall cost of operations. The company is also looking to operate in states like Kansas and Oklahoma where the geology is suitable for injection wells, and where farm waste is abundant. By producing the oil closer to disposal wells, it can save money on transportation. Charm is also working to turn some of the bio-oil into a mixture of hydrogen and other gases called syngas that can be used to make green steel.

Government programs could also help Charm bring its costs down. A federal tax credit known as 45Q will eventually pay companies up to $50 per ton of carbon dioxide equivalent sequestered underground. Right now it only applies to CO2 gas, but Charm hopes to lobby to get the definition expanded to include bio-oil. Similarly, the company would like to become eligible to generate credits under California’s low carbon fuel standard, a status that direct air capture facilities recently gained. Charm could then sell those credits to fuel producers to help them comply with California’s emissions standards.

Right now Charm’s carbon removal service depends entirely on companies voluntarily paying for it. Demand didn’t end with Microsoft. Charm recently opened up shop for any interested parties to purchase carbon removal credits through markets like Sourceful and Aerial. Stripe has also made it possible for its software customers to direct a small portion of their revenues to fund carbon removal through Charm. Still, it’s unclear how far this kind of altruism will get the company without government regulations or a price on carbon.

In April, Charm announced that it had successfully fulfilled Stripe’s carbon removal purchase, pumping enough bio-oil into disposal wells in the Midwest to store 416 metric tons of carbon. Charm would not specify where the wells were. Reinhardt told Grist the company has sequestered more than 1,200 metric tons of carbon dioxide equivalent underground in 2021. By comparison, a direct air capture pilot plant in Iceland that began injecting CO2 underground in 2017, the only such facility of its kind to date, could store 50 metric tons of CO2 per year. (The companies behind the pilot plant, Climeworks and Carbfix, are building a new facility that can bury 4,000 metric tons of CO2 per year.)

When I last spoke with Meehan, Charm had just hired its 14th employee, and he was furiously busy trying to figure out how to keep up with demand for its services. Less than two years after that fateful meeting with the investor, his faith in Charm was restored, and then some: “I think we have a way to make this potentially the largest negative carbon company that’s ever existed.”

*This piece was updated to reflect that Shopify made a purchase from Charm. It is not an investor in the company.