One of the big drivers of energy efficiency in the U.S. over the last decade has been the growth of efficiency programs at electric and gas utilities, funded by utility customers. Total spending on such programs went from $2 billion in 2006 to $4.8 billion in 2010. Given the dire need to reduce the energy intensity of the U.S. economy, what can we expect from those programs over the next decade or so?

It’s funny you should ask! As it happens, the ninja wonks over at Lawrence Berkeley National Laboratory (LBNL) just released a report on this very subject [PDF]. They set out to estimate total spending and total savings on utility efficiency programs out to 2025, assuming no policy change (that’s important). For each state they did a low, medium, and high scenario, to account for uncertainties regarding policy implementation, rate caps, and various broader market drivers like natural gas prices and the pace of economic recovery.

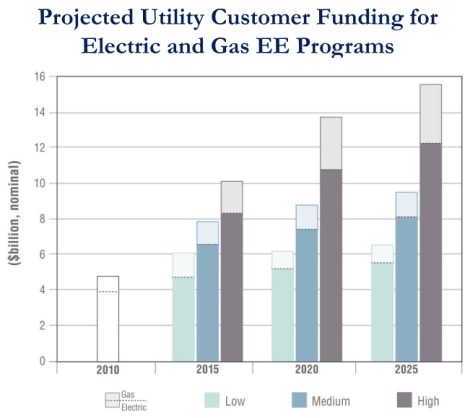

Here’s what they found:

As you can see, in the medium case total spending roughly doubles from 2010 levels, to $9.5 billion in 2025. As spending grows, energy savings grow alongside. In 2010, efficiency trimmed about 0.5 percent of annual U.S. retail electrical sales. In the medium case, that number will rise to 0.76 percent by 2025. By way of comparison, the EIA projects about 0.58 percent growth in retail electricity sales by 2025. So growth in utility energy efficiency programs could offset some or all of that new energy demand.

Most of the rise in electric efficiency spending — more than two-thirds of it — is driven by state policy, either renewable energy standards that include efficiency, freestanding energy-efficiency resource standards, or direct mandates to utilities to exploit “all cost-effective energy efficiency.” Since policy is not evenly spread, spending isn’t either — it’s higher in the Northeast and the West. Over the next 10 years, LBNL projects that most new electric efficiency spending will come from the South and Midwest and spending will become more evenly distributed.

There are a few reasons LBNL might be overestimating utility efficiency growth. Economic recovery could be slower than expected. Natural gas prices might sink even further. State and federal efficiency standards for lighting and appliances might get more ambitious and eat up more of the “low-hanging fruit.”

But there are also reasons LBNL might be underestimating growth. Remember, this is an assessment of what happens with no new policy. We won’t be that stupid, will we?

To me, the take-home lesson of the report is simple: Today’s energy efficiency policy is insufficient. Spending rises sharply out to 2015 (11 percent a year in the medium case) and then slows all the way down to 2 percent a year from 2020 to 2025. We need to be thinking about exponentially higher spending — doubling year on year.

And getting to 0.75 percent total efficiency savings by 2025 isn’t enough either, not even close to what’s required as part of a serious carbon reduction program. We need to be aiming at 3 percent, 5 percent, 10 percent savings.

That means ambitious new policy, and lots of it.