What is driving the decline of the U.S. coal industry? Most of the blame has gone either to Obama’s “war on coal” (EPA regulations) or to cheap natural gas. But there’s a third factor at work, which has gotten much less press:

Coal is getting more expensive to produce.

Why? First, the easiest-to-reach coal has been mined, which means coal companies have to dig deeper and go after thinner seams and smaller deposits. That costs more, in both energy and money. And second, transportation costs, mainly the cost of the diesel fuel that runs the trains that carry the coal, are rising.

It has gotten the point where, in some areas, profit margins have flipped: coal is now selling for less than it costs to produce. In other areas, that flip appears to be perilously close. Never mind EPA or natural gas or Obama or anything else: If it isn’t profitable to mine coal, it won’t be mined, not for long.

Stephen Mufson of The Washington Post wrote a broad overview of this subject last week. Let’s dig a little deeper and look at a few data points.

——

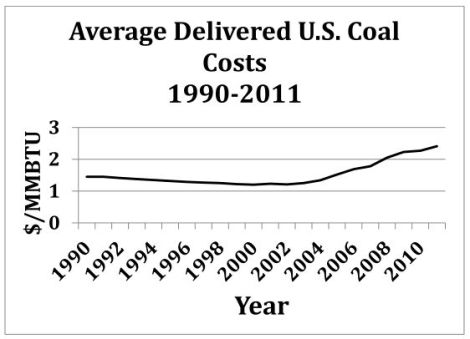

The fact that coal is getting more expensive in the U.S. is no secret. Here’s a graph drawn from Energy Information Administration data:

(This is from a great report by Clean Energy Action: “Trends in U.S. Delivered Coal Costs: 2004-2011.” You can find state trends in there too.)

A technical note: MMBTU stands for million metric British thermal units. You don’t want to compare fossil fuel sources by weight, since some forms are more energy-dense than others. (Hard anthracite coal, for instance, contains more energy per ton than softer bituminous coal.) A BTU is a unit of heat energy, not weight, so MMBTU offers apples-to-apples comparisons among fuels.

As you see, in 2000 coal was down near $1/MMBTU, considerably lower in many states. As long as it was that cheap, it didn’t matter so much if natural gas prices sank all the way down to $4 or even $3. (Right now natural gas is around $3.43/MMBTU.) But the price of coal has been heading steadily upward. The average is now between $2 and $3/MMBTU, higher in many states. At those prices, coal loses its only advantage over gas, which offers less pollution, smaller and easier-to-finance power plants, and a better fit for a grid with increasing amounts of variable renewables. The higher coal costs rise, the more vulnerable coal is to competitors.

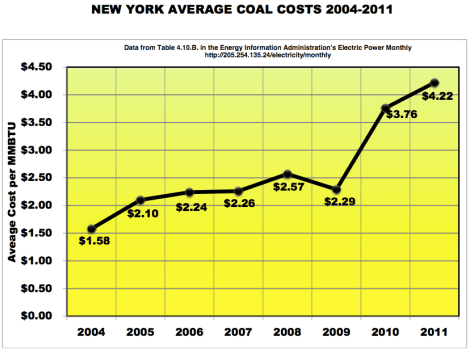

An illustrative example: In January, AES Eastern Energy, which owns six coal-fired power plants in New York, declared bankruptcy. Cheap natural gas was part of it. EPA regs were part of it. But another, overlooked part was the fact that the delivered cost of coal in New York has exceeded $4/MMBTU:

That’s simply not competitive.

——

Let’s look at how rising coal-production prices are affecting the big three coal companies: Peabody Energy, Alpha Natural Resources, and Arch Coal.

First, a poignant story. Coal execs are well aware that coal for electricity production (“thermal coal”) is on the decline thanks to natural gas, so to hedge against those losses, they recently invested heavily (to the tune of $20 billion) in metallurgical coal, which is used in steel making. After all, JPMorgan Chase & Co. forecast last year that metallurgical coal prices would rise by 50 percent in 2012.

Turns out that was not a good bet. Instead of rising 50 percent, prices for metallurgical coal fell by 16 percent, exactly like prices for thermal coal.

“There was some belief that there was countercyclicality between [metallurgical] and thermal,” said David Gagliano, an analyst at Barclays in New York. “What we’ve learned is that they aren’t that different.”

Oops. The result:

Alpha’s 70 percent [stock] drop in 2012 makes it the worst performer on the 29-member Stowe Global Coal Index, which lost 31 percent in the period. Arch is down 57 percent, and Peabody has declined 32 percent in the period.

That grim tale is illustrative of the fortunes of these companies lately. They can’t hack it in these market conditions.

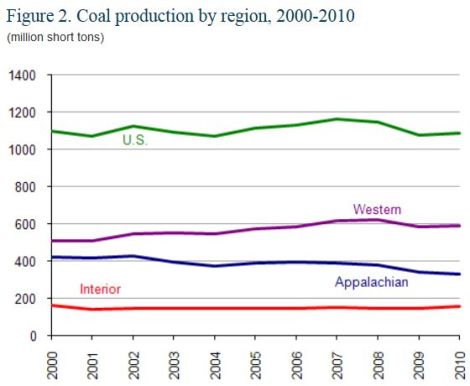

Consider the saga of eastern coal. The basic situation with coal mining in the U.S. is that it’s been migrating from east to west for several years now. A decade ago, the Powder River Basin (PRB) in Wyoming and Montana produced roughly as much coal as Central Appalachia. But PRB coal has been on the rise, and Central Appalachian coal on the decline — from 24 percent of U.S. supply in 2000 to 17 percent in 2010. In 2010, U.S. coal companies mined 592 million short tons of western coal (up 1.1 percent from 2009) and 334 short tons of Appalachian coal (down 2.1 percent from 2009).

So things are not looking great for coal companies invested in Appalachian coal. And the decline is not about Obama’s war on coal, it’s about geology’s, reports the West Virginia State Journal:

“West Virginia has more problems than just a ‘war on coal,'” [economic geologist Alan Stagg, president of Stagg Resource Consulting,] said. “It’s about the physical properties of the coal that’s left. The reserves are being depleted, and anybody that’s spent any time looking at coal properties and reserves cannot tell you otherwise with a straight face.”

Remaining southern West Virginia coal beds are thin, he said, meaning more rock has to be mined to get the coal — decreasing productivity and increasing cost.

More beds are split, with partings, he said, also decreasing productivity and increasing cost. Reserves are in relatively small, scattered blocks, in rugged terrain where it’s difficult to achieve the efficiencies of a single mining complex where everything feeds into the same preparation plant.

“There’s a lot of inherent, basically physical, attributes of the coal reserves that remain in southern West Virginia that cause these problems,” Staggs said after speaking at a Platts coal conference. …

“It’ll never come back like it was,” he said. “And people don’t make good decisions if they think it will — whether it’s politicians, or legislators, or business people, or the average man or woman on the street. If I’m a coal miner in Boone County, I might think I’m going to ride this out — take my savings, hunker down like I’ve done before, like my daddy did before, until it comes back. That’s not a good decision.”

“There are things that are,” he concluded, somewhat poetically. “This is the way it is.” Appalachian coal isn’t coming back.

To wit: Patriot Coal, a subsidiary of Peabody that runs its eastern mining operations, went bankrupt in July. It posted a $215.9 million net loss in Q3 of this year. The U.S. trustee overseeing its bankruptcy “argu[ed] that the company appears ‘hopelessly insolvent’ and that there is no chance of recovery for remaining shareholders.” The company is using the bankruptcy as an excuse to try to delay meeting its environmental obligations and screw its miners out of their health and pension benefits. The miners are suing. (Remind me again who’s a friend of coal miners?)

Patriot parent company Peabody is doing somewhat better. This bit of stock analysis is revealing. It says that Peabody profit margins are better than those of Arch Coal (which owns mostly U.S. coal) but worse than those of BHP Billiton (a multinational mining company). Peabody is in the middle, with a lot of U.S. coal but lots of mines in other countries as well, notably Australia. In other words. coal companies appear to be healthier the less U.S. coal they own.

Still, the analyst finds Peabody suffering from “fundamental weakness,” as demonstrated by Bank of America downgrading its stock from Buy to Underperform.

Then there’s Alpha Natural Resources, America’s second biggest coal company by revenue. (It’s the company that bought mountaintop-removal mining outfit Massey Energy last year.) Its reserves are also concentrated in Appalachia. Check out some numbers in its second quarter earnings report. The sale price for a ton of Eastern coal this year (through June) was $66.29 a ton. The production cost? $75.09. I’m no economist, but selling your product for less than it costs to produce it doesn’t sound sustainable. “Despite signs of improvement in the domestic thermal coal market,” the company concedes, “conditions remain challenging.”

The market agrees: Alpha was put on “CreditWatch negative” by Standard & Poor’s in September. Shortly thereafter, it was booted from the S&P 500. Greg Ruel at GMI Ratings says Alpha has “continued to increase its risk of bankruptcy or financial distress” and poses an “imminent danger to shareholders” (!).

And finally there’s Arch Coal, the second biggest U.S. coal company by production. Arch is, in the words of this stock analyst, among the “walking dead.” Debt exceeds sales. Profits are falling. “At this point Arch in survival mode, waiting for coal markets to turn around.” More like hoping.

——

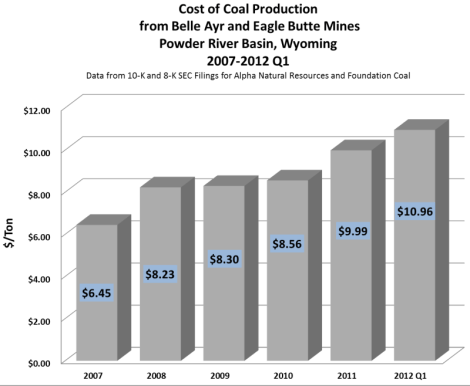

The story around Powder River Basin coal isn’t quite that grim, but the same forces are at work. Production costs are rising. Here’s data from the Alpha-owned Belle Ayr and Eagle Butte mines in Wyoming:

Meanwhile, several PRB mines are seeking to expand, to extend their lives. But in almost all cases, those expansions would push into areas where coal is deeper and harder to reach, pushing costs even higher.

Consider the case of Arch-owned Black Thunder Coal Mine in Wyoming — the largest coal mine in the country, which represents over 10 percent of total U.S. production. In Q2 of this year, its profit margin for a ton of coal sank to $0.94. That is tight. By Q3 it was back up to $1.28, but that still isn’t very impressive, especially given the absurdly low prices at which the U.S. government is leasing PRB tracts.

Now Black Thunder is looking to expand into the nearby West Hilight area. Will its profit margins improve there? Probably not. As Bureau of Land Management’s environmental impact statement for the area shows, the mining operation will have to hop over the Joint Line railroad into an area where “overburden” (the stuff sitting on top of the coal) is 400 feet deep — 100 feet deeper than what is being mined now. That will increase production costs and push profit margins down.

So that’s the status of PRB coal mining: The profit margins are already slim and the coal that’s left to mine is deeper and more difficult to reach.

——

So, to review the fortunes of the top three U.S. coal companies:

- Peabody spun off its eastern operations into Patriot Coal, which promptly went bankrupt and is now screwing miners out of their pensions. Peabody itself is struggling but staying alive by mining in other countries.

- Alpha Natural Resources is on the edge of bankruptcy.

- Arch Coal is in “survival mode.”

As I’ve said before, the only hope U.S. coal companies have to improve their fortunes is to export more coal. Having China and India bidding on the coal could potentially push the price up (which isn’t going to help U.S. coal utilities) and improve profit margins.

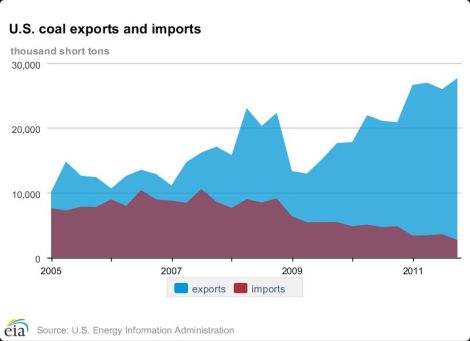

Coal exports have been rising quickly:

Nonetheless, it’s not quick enough to offset the other forces driving coal companies into the red. To save their own bacon, they will need to carry coal from the Powder River Basin to coal export terminals on the West Coast, from whence it will travel to (mostly) Asian countries. To do that, they will need to run hundreds more coal trains and build big, loud, polluted terminals in some bucolic West Coast towns. Coal companies are spending tons of money now on propaganda aimed at winning over West Coast voters, but it’s going to be a huge fight.

If climate activists succeed in bottling the coal up, preventing the West Coast escape hatch, the U.S. coal industry — faced with rising production costs, vicious competition from natural gas, and new EPA regulations — could collapse in on itself. It’s far from a sure thing, but it’s not out of reach. Coal is a paper tiger, far more vulnerable than virtually anyone in U.S. politics understands.