McKinsey & Company is a very large, very old, very prestigious consulting company. They’ve just released an ambitious report called "Reducing U.S. Greenhouse Gas Emissions: How Much at What Cost?"

Here’s what they did:

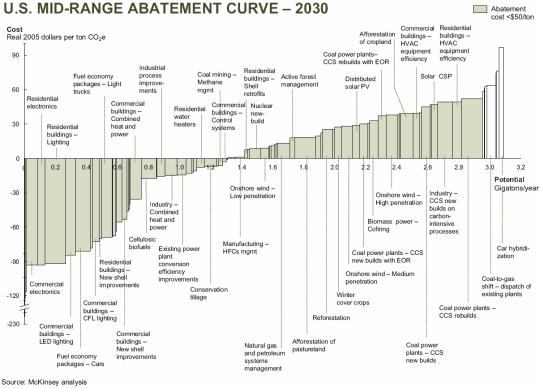

Starting in early 2007, a research team from McKinsey worked with leading companies, industry experts, academics, and environmental NGOs to develop a detailed, consistent fact base estimating costs and potentials of different options to reduce or prevent GHG emissions within the U.S. through 2030. The team analyzed more than 250 options, encompassing efficiency gains, shifts to lower-carbon energy sources, and expanded carbon sinks.

Here’s what they found:

The United States could reduce GHG emissions in 2030 by 3.0 to 4.5 gigatons of CO2e using tested approaches and high-potential emerging technologies. These reductions would involve pursuing a wide array of abatement options with marginal costs less than $50 per ton, with the average net cost to the economy being far lower if the nation can capture sizable gains from energy efficiency. Achieving these reductions at the lowest cost to the economy, however, will require strong, coordinated, economy-wide action that begins in the near future.

Executive summary (PDF). Full report (PDF).

It’s well worth reading the summary. There’s tons of great stuff, but this jumped out at me:

Almost 40 percent of abatement could be achieved at “negative” marginal costs, meaning that investing in these options would generate positive economic returns over their lifecycle. The cumulative savings created by these negative-cost options could substantially offset (on a societal basis) the additional spending required for the options with positive marginal costs. Unlocking the negative cost options would require overcoming persistent barriers to market efficiency, such as mismatches between who pays the cost of an option and who gains the benefit (e.g., the homebuilder versus homeowner), lack of information about the impact of individual decisions, and consumer desire for rapid payback (typically 2 to 3 years) when incremental up-front investment is required.

Here’s a representation of that startling fact (click for a larger version) — the negative-cost options are on the left and the positive-cost options on the right: