As we saw, coal utilities are trying to scare Congress into thinking that if EPA follows up with its planned regulations, electricity rates will soar and there will be reliability problems in the electricity grid. Is it true?

According to a comprehensive new analysis, no. It’s not true.

The report was commissioned from M.J. Bradley & Associates (MJBA) by a group of electric companies. MJBA recruited Susan Tierney to coauthor the report, which is pretty significant. Tierney is a widely respected expert on these issues who worked under governors of both parties in Massachusetts, in the Energy Department under Clinton, and on Obama’s Energy Department transition team. She’s the real deal. The report is called “Ensuring a Clean, Modern Electric Generating Fleet while Maintaining Electric System Reliability” [PDF].

I won’t test your patience with too many details. The basic conclusion is that, yes, utilities can achieve the health and social benefits of new EPA regulations without sacrificing electrical reliability. The report acknowledges that some power plants will retire rather than face the cost of pollution controls, but the electricity system as a whole won’t be compromised “if the industry and its regulators proactively manage the transition to a cleaner, more efficient generation fleet.”

A few reasons for confidence that grid reliability can be maintained through the transition:

1. Remember that huge buildout of new natural-gas power plants in the early 2000s, which I mentioned in my first post? Turns out it was a bit of an over-build, based on temporarily low gas prices. Partly as a consequence, the country has tons of slack generating capacity, around 100 GW worth.

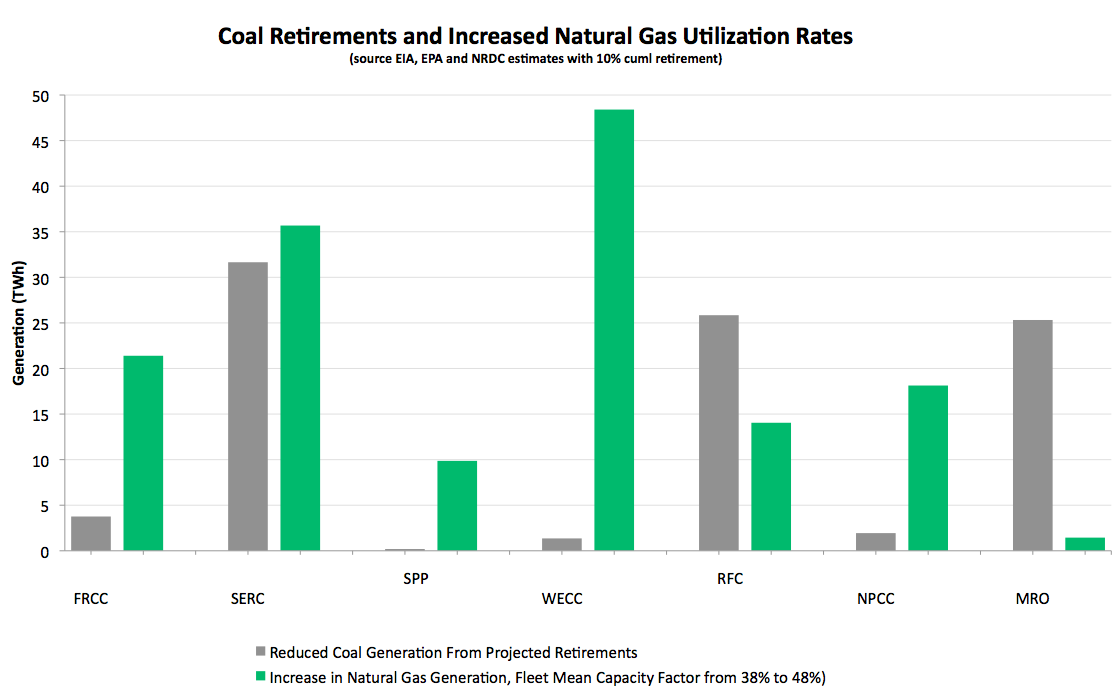

According to MIT [PDF], that big fleet of natural-gas plants runs, on average, 38 percent of the time. If they were run modestly more often — say, 10 percent more — they alone could compensate for lost coal capacity in most regions of the country. This graph from NRDC’s Samir Succar lays it out (click for larger version):

Those inscrutable acronyms are regions as defined by the North American Electric Reliability Corporation.NRDC

Those inscrutable acronyms are regions as defined by the North American Electric Reliability Corporation.NRDC

2. There’s lots of new capacity in the pipeline. According to the “Edison Electric Institute Preliminary Reference Case and Scenario Results” [PDF], there’s about 55 GW of generation in advanced development, sitting in the transmission queue for 2013. “Although not all of these plants will be built,” says the MJBA report, “strong market incentives and signals from regulators that new capacity will be needed will promote generation development proposals beyond those announced to date.”

3. The recession has suppressed demand growth. The North American Electric Reliability Corporation (NERC), in its “2009 Long-Term Reliability Assessment: 2009-2018” [PDF], notes that “the economic recession is responsible for significant reductions in projected long-term energy use in North America.” Specifically:

Energy use projections in last year’s report (for 2009) are now projected for 2011. Forecasts indicate that Total Internal Demand will increase in most areas through 2018, but at a slower pace and from a lower starting point.

4. Utilities have more and more demand-side options, including smart-grid technology, energy-efficiency programs, and what the wonks call “demand response” (DR), which amounts to moving energy consumption out of peak-use hours.

A report [PDF] from the Federal Energy Regulatory Commission (FERC) shows that demand response alone can crank down peak electricity demand by as much as 20 percent. Meanwhile, according to the MJBA report, utility energy-efficiency programs …

…. resulted in savings of almost 105,000 gigawatt hours (GWh) of electricity in 2008 — the equivalent of the total electricity consumption in Tennessee in the same year. By 2018, new EE programs alone are expected to reduce summer peak demands by almost 20,000 MW (a full year’s growth).

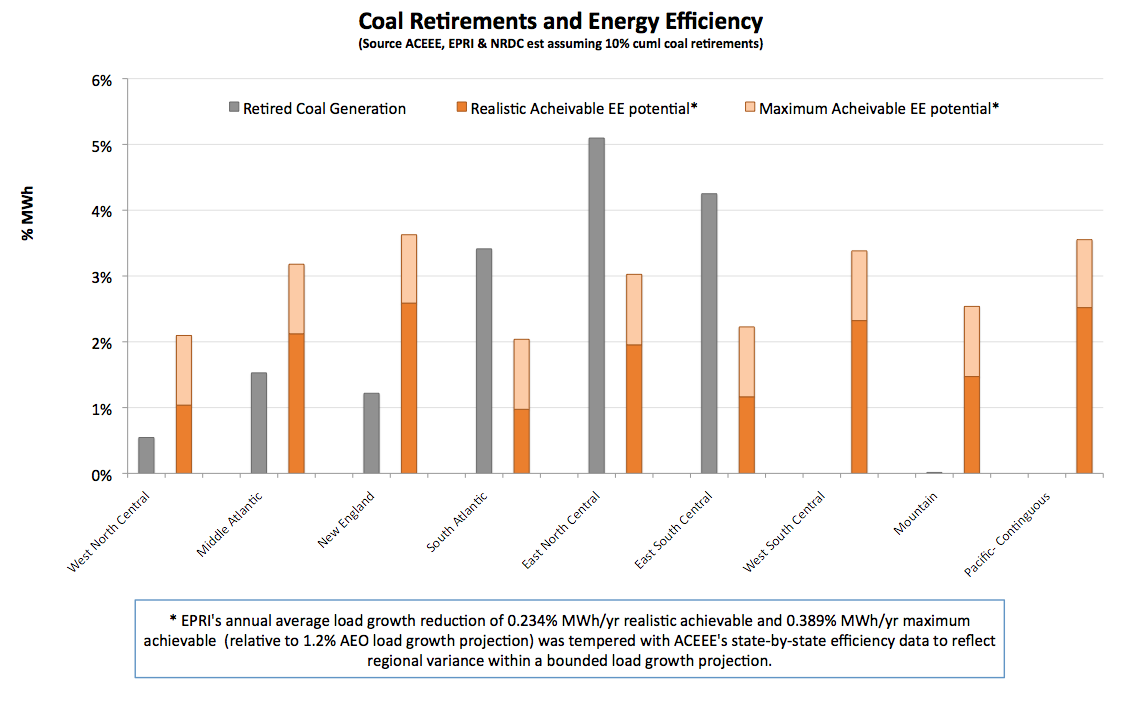

In many regions, energy efficiency alone can compensate for the loss of old, coal-fired generation. Here’s another illustrative graph from NRDC (click for larger version):

With demand-side options, you are replacing coal generation, which costs money and pollutes a lot, with efficiency, which saves money and is 100 percent pollution-free. Pretty nifty!

5. From MJBA: “Industry data counter concerns that it will cost the industry too much to comply with EPA’s proposed air regulations, that pollution controls cannot be installed soon enough, or that the EPA regulations will lead to the closure of otherwise economically healthy power plants.“

This bit gets slightly technical, but to cut to the chase, the technology to reduce pollutants is available (65 percent of coal plants have already installed it) and utilities have demonstrated their ability to phase it in quickly, without service disruptions. The power plants that will get shut down instead of upgraded will already be the oldest, dirtiest, and least economically viable.

6. From MJBA: “EPA, the Federal Energy Regulatory Commission, the Department of Energy, and state utility regulators, both together and separately, have an array of tools to moderate impacts on the electric industry.“

This gets a bit technical too, but the gist is that even if everything goes as horribly as utilities predict, federal agencies have plenty of tools at their disposal to head off reliability problems. EPA can grant case-by-case extensions; EPA or DOE can issue consent decrees; FERC can adjust market rules. If we see trouble developing, nothing in EPA regulations locks us in.

——

It’s clear from the MJBA report that utilities can comply with new EPA regulations without undue threat to the electric system or electric ratepayers. The combination of excess existing capacity, new capacity in the pipeline, and demand-side programs can compensate for the loss of old coal-fired generation capacity.

While the switch from grandfathered, filthy old

coal to newer natural gas and wind will raise electricity rates, demand-side programs can lower electricity bills. Even if there’s a modest net rise in electricity prices, ratepayers will be paying a little to get a lot. According to EPA, when fully implemented its impending regulations on mercury and other hazardous air pollutants …

… would yield combined health benefits estimated at $18 to $44 billion annually. These benefits include preventing between 2,000 and 5,200 premature deaths, and about 36,000 asthma attacks a year. Estimated annual costs of installing and operating pollution controls required under these rules would be $3.6 billion.

[See update below.]

Of its new Clean Air Transport Rule, EPA says [PDF]:

The proposed rule would yield more than $120 to $290 billion in annual health and welfare benefits in 2014, including the value of avoiding 14,000 to 36,000 premature deaths. This far outweighs the estimated annual costs of $2.8 billion.

Add these two rules together and you get annual costs of $6.4 billion in exchange for annual benefits between $138 and $334 billion. Not a bad deal! And that’s to say nothing of the additional health benefits from the coal ash, particulate matter, and CO2 rules.

Phasing out the oldest, dirtiest coal plants can be done safely and quickly. The public welfare benefits are enormous. Justice and equity demand it. So why not do it?

——

[UPDATE: A sharp-eyed reader notes that the first cost-benefit analysis above is for the hazardous pollutant regulations for industrial, institutional, and commercial boilers — not for power plants. Hazardous pollutant regs for power plants — NESHAPS — won’t be released until next year and so EPA has not yet released a cost-benefit analysis for them. Their benefits are expected to be huge — along the lines of the benefits for CATR. The basic points stands, though: the benefits of these regs wildly outweigh the costs.]