This post was co-authored by Susan Lyon.

I was out driving/just a taking it slow

Looked at my tank/ it was reading low

Pulled in a Exxon station/out on Highway One

Held up without a gun

Held up without a gun

Springsteen’s song could not be more true today. Big Oil is once again riding high oil prices to large profits (see below) while American consumers get stuck with a $2.7 billion gasoline bill in the first quarter of 2010 due to higher oil prices. But the problems with oil go beyond these companies’ profits. Rising oil prices also add more filthy lucre to the coffers of hostile regimes, including Iran.

Meanwhile, the Gulf of Mexico is suffering a huge oil spill while taxpayers spend billions of dollars paying for tax loopholes for Big Oil. And Big Oil spends record amounts of money to pressure Congress to cement these loopholes in place and defeat clean energy legislation. Adding injury to insult, big oil opposes energy and global warming legislation that would reduce our reliance on oil.

Enough is enough. We need Congress to stand up to Big Oil and pass legislation that addresses the problems with oil profits and oil use. Sens. John Kerry (D-Mass.), Lindsey Graham (R-S.C.), and Joe Lieberman (I-Conn.) are working on legislation that would reduce oil dependence and put a declining limit and rising price on carbon. These measures would reduce our dependence on oil, increase national security, create jobs, and cut pollution.

Mo’ prices, mo’ problems

U.S. crude oil prices rose from $31.76 per barrel in January 2009 to $85.17 by April 29, 2010 after a price slump at the end of 2008. This is an increase of nearly 160 percent over a 15-month period. The Energy Information Administration recently predicted that oil prices will rise to above an average of $81 per barrel by this summer while average gasoline prices will likely exceed $3.00 per gallon this spring. Drivers will pay 17 percent more for gas compared to summer 2009 — $174 million per day, or an average of $602 per household annually. Energy price volatility like this hurts consumer and business investments, causing families to delay buying a car and spend less on buying or upgrading their homes. Businesses also cut investments, while profits surge in the oil and gas industry.

While higher prices brought higher profits to Big Oil, they also brought higher gasoline prices that cost American consumers millions during the first quarter. A CAP analysis determined that higher oil and gasoline prices forced Americans to spend $2.7 billion more on gasoline during the first quarter compared to what they would have spent had prices remained steady after the first week.

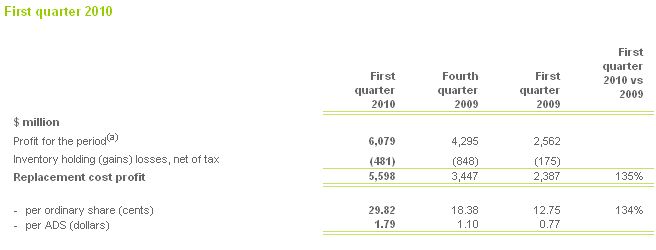

Much of the U.S. economy is slowly recovering from a deep recession, but oil companies continue to prosper. The big five oil companies — BP, Chevron, ConocoPhillips, ExxonMobil, and Shell — announced huge first quarter profits — four of the five companies announced profits larger than analysts predicted. As the chart below shows, big oil saw profits in the first quarter of 2010 that far eclipse analysts’ projections and are significantly higher than 2009 profits as well.

Big five oil company profits for the first quarter of 2010 vs. first quarter 2009

BP’s 2010 first quarter profits were $5.6 billion, a 135 percent increase over the first quarter of 2009. This profit was 50 percent higher than predicted by The Financial Times. Shell announced that its profits had risen by 49 percent since the first quarter of 2009. Chevron’s profit was $4.6 billion, a 156 percent increase, while ConocoPhillips had $2.1 billion in profits. The world’s largest private oil company, ExxonMobil, had a first quarter profit of $6.8 billion, which was 38 percent more than 2009.

Iran: Thanks for high oil prices

Higher oil prices also benefit nations that are hostile to U.S. interests — even if we don’t purchase any oil from them — such as Iran. Every $1 increase in the price of oil provides an additional $1.5 billion to Iran annually.

Conversely, adoption of a shrinking limit on carbon pollution that reduces it by 80 percent by 2050 would reduce the use of oil and lower its price, costing Iran approximately $1.8 trillion in lost oil revenues over the next 40 years — over $100 million a day. These petrodollars fund and prop up unfriendly regimes, enabling them to support terrorists in other nations.

Sea of fire

Oil companies deserve to earn a profit since oil exploration and development can be financially and technically risky business. At the same time, though, they must produce this oil in a safe and environmentally sustainable manner. Yet despite rhetoric to the contrary about advances in environmental safeguards, the spill off the Louisiana coast shows that offshore oil development still poses a threat to its workers and risk to the ocean and coastal environment.

BP owns the oil rig that exploded and sunk in the Gulf of Mexico last week, causing what CNN reports officials say “could become one of worst spills in U.S. history.” Tragically, there are 11 missing rig employees who are presumed dead. The well continues to leak 210,000 gallons of oil per day into the Gulf of Mexico — five times the original estimate. This growing oil slick already covers an area larger than West Virginia and oozed onto the Louisiana shore early this morning. A major portion of the oil slick looms only five miles offshore. This major oil spill could be the worst environmental disaster since the Exxon Valdez spill in 1989, and it is a tragic reminder that we must dramatically reduce our oil use.

The Exxon Valdez spill cost Alaska’s fishermen an estimated $800 million in damages to their livelihood. This oil spill could bring an economic Armageddon to the gulf coast seafood industry. Bloomberg reports:

Louisiana is the largest seafood producer in the lower 48 states, with annual retail sales of about $1.8 billion, according to state data. Recreational fishing generates about $1 billion in retail sales a year, according to the state.

BP should be required to place its first quarter profit of $5.6 billion in an escrow account to provide compensation to the fishermen whose livelihoods are threatened. These funds should also be used for cleaning up the soon to be blighted shores.

Oil tax loopholes: More money for the misbegotten

Despite high prices and profits, big oil companies still want taxpayer-funded loopholes even though some conservative oil men believe they are unnecessary. In 2005, former oil man and President George W. Bush noted that with higher oil prices big oil does not need tax breaks to explore and develop oil fields.

I will tell you with $55 oil we don’t need incentives to the oil and gas companies to explore. There are plenty of incentives. What we need is to put a strategy in place that will help this country over time become less dependent.

Yet even with today’s prices more than 50 percent higher than $55 per barrel, Big Oil companies want to maintain tax loopholes that siphon additional billions of dollars from U.S. taxpayers. Taxpayer money pays for the tax breaks claimed by Big Oil, but the industry claims that closing these loopholes is really a new energy tax on them. American Petroleum Institute President Jack Gerard stated:

With America still recovering from recession and one in ten Americans out of work, now is not the time to impose new taxes on the nation’s oil and natural gas industry. New taxes would mean fewer American jobs and less revenue at a time when we desperately need both. A robust U.S. oil and gas industry is essential to the recovery of the nation’s economy.

Contrary to this assertion, cutting the subsidies to Big Oil would help our economy while shrinking the federal budget deficit. In fact, a state-by-state analysis indicates that taxpayers would actually save money if the subsidies and tax breaks were lifted. A recent CAP analysis found that the effective federal income tax rate in the United States for major oil companies is lower than the effective tax rates they face abroad — sometimes close to 50 percent lower. The report also determined that subsidies to the oil industry will cost the U.S. government about $3 billion in lost revenues next year and nearly $20 billion over the next five years.

These estimates are only the initial assessment — they still vastly underestimate the help that the oil industry receives from the government via extensive hidden tax code benefits as well.

Big Oil squeezes the Capitol

Given the generous subsidies Big Oil receives, it should come as no surprise that this industry is fighting hard to keep their loopholes and block reform. There was record oil and gas industry lobbying in 2009. These companies spent at least $154 million on squeezing Congress that year-more than 16 percent higher than 2008. Big Oil’s lobbying and political arm — the American Petroleum Institute — alone spent at least $7.3 million on lobbying in 2009 and another $1.3 million more in 2010 to kill legislation. API has also spent millions of dollars running expensive print, TV, and radio ads to do the same. The American Petroleum Institute alone “doled out $75.2 million for public relations and advertising” in 2008.

Congress must act

In short, Big Oil’s profits climb higher and higher as American consumers feel more and more pain at the pump. This needs to stop.

Sens. John Kerry (D-Mass.), Lindsey Graham (R-S.C.), and Joe Lieberman (I-Conn.) are developing bipartisan comprehensive energy legislation that would reduce oil dependence and put a declining limit and rising price on carbon. These provisions would increase American energy independence (and our national security), create jobs, produce “Made in the USA” clean energy technologies, and cut pollution. The bill should also establish much stricter safeguards for existing offshore oil production.

Additionally, Congress should cut subsidies to big oil and level the playing field for safe, clean energy sources. Further, we need to curb the economic, social, and environmental damage that our consumption of dirty fuel causes. To achieve these many goals, Congress must act swiftly to pass bipartisan comprehensive energy and climate reform.

Methodology

We used the weekly price and quantity data supplied by the EIA’s U.S. prices and consumption database to calculate how much more Americans spent on gas in the first quarter of 2010 relative to what they would have spent had prices remained steady after the first week of January 2010. Using their data from the “Finished Motor gasoline product supplied” and “Conventional retail gas prices” sections, we multiplied the average weekly product supplied value times that week’s recorded price, doing this separately for each week of the first quarter. From here, the initial week’s value was subtracted from each other weeks to obtain how much more was spent each week relative to the first. Aggregating this column resulted in the final figure.

See also:

- Big Oil Awash in Profits by Daniel J. Weiss and Susan Lyon

- Quenching Our Thirst for Oil by Susan Lyon, Rebecca Lefton, and Daniel J. Weiss