Getting an audience with Silicon Valley’s guru of green investing isn’t always easy.

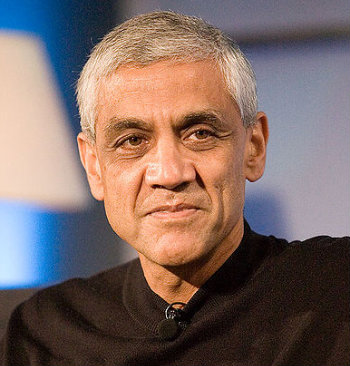

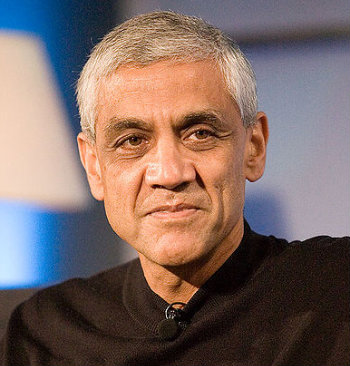

Vinod KhoslaJames Duncan Davidson/O’Reilly Media, Inc. (via Wikimedia Commons)If Vinod Khosla is not speaking at one of the innumerable, and apparently recession-proof, green business conferences that seem to happen every other week, he’s giving lectures at Google headquarters, writing white papers, or, of course, inking checks to green tech startups with the potential to disrupt multi trillion-dollar global industries like energy, automobiles and building materials.

Vinod KhoslaJames Duncan Davidson/O’Reilly Media, Inc. (via Wikimedia Commons)If Vinod Khosla is not speaking at one of the innumerable, and apparently recession-proof, green business conferences that seem to happen every other week, he’s giving lectures at Google headquarters, writing white papers, or, of course, inking checks to green tech startups with the potential to disrupt multi trillion-dollar global industries like energy, automobiles and building materials.

He’s something of a Valley legend: Co-founder of Sun Microsystems, then a longtime tech investor with marquee venture capital firm Kleiner Perkins Caufield & Byers and now head of Khosla Ventures, which he started in 2004 to invest in green tech startups.

Khosla and his partners had been investing their own money, but earlier this month the firm announced it had raised $1.1 billion for two funds — one of which is the largest first-time fund in a decade. It was a rather staggering amount, given that clean-tech investing has plummeted from $4 billion in 2008 to $513 million so far this year, according to PricewaterhouseCoopers, as the “Great Recession” continues to take its toll. Putting money into the two Khosla funds was the nation’s largest pension fund, the California Public Employees’ Retirement System.

It’s not the size of Khosla’s fund but what he intends to do with it that should command your attention. In short, he wants to take the green out of green investing and globalize the bottom line.

“I like to call it ‘main tech,’ not clean tech,” says Khosla, dressed in his trademark black, when I snagged some time with him at his Sand Hill Road office in the hills above Stanford University. “We’re doing bioplastics, lighting, engines, water, and air conditioning. It’s a very broad view. Almost anything that can be made renewable, sustainable, more efficient, and cheaper.”

Khosla has a reputation as a contrarian, annoying both fellow investors and environmentalists when he disses the potential of electric cars, photovoltaics and other in-vogue technologies to make a meaningful impact on climate change. While he has poured money into solar and biofuel startups and other companies developing exotic new technologies, he’s just as interested in greening old tech.

“We just hired a great guy out of Detroit to come here on an engine startup,” says Khosla. “If you can improve the efficiency of engines by 30 to 40 percent, you can cut world oil consumption by a lot. That’s exciting stuff.”

Khosla is funding at least five startups focusing on mechanical efficiency, developing everything from circuit boards to more efficiently control a car’s systems to better fuel injection systems. Another 10 companies — with names like Kaai, Ramu and Sakti3 — are working on electrical efficiency. (Some are so far below the radar that they don’t maintain Web sites.)

A portion of his portfolio is devoted to what Khosla likes to call “science experiments,” or “black swan” technologies. Seventeenth century Europeans assumed that all swans were white until the discovery of black swans in Western Australia in the 18th century. In this century, former financier Nassim Nicholas Taleb developed a theory of what he called “black swan events” to describe the impact of rare, big impact, hard-to-predict historical occurrences, like the advent of the Internet or the 9/11 attacks.

For Khosla, a world-changing black swan technology would be batteries that could store massive amounts of electricity generated by solar and wind farms or cheaply power electric cars for hundreds of kilometers on a charge. (Among Khosla’s stealth startups is Sakti3, a Michigan venture whose bare-bones Web site says it is developing “advanced solid-state rechargeable lithium-ion battery technology.”)

The operational word here is cheaply. For Khosla, the bottom line on any technology is whether it can be scaled at a price where it will be adopted without subsidies in countries such as China and India. It’s there, he says, where climate change solutions must take root if there’s to be any chance of effectively fighting global warming. In other words, entrepreneurs hoping to lure Khosla money must pass the “Chindia test.”

“Where’s the growth in energy? It’s in India and China,” he says. “And guess what, they don’t have the same rules. You don’t get a hybrid car credit in any of those countries. In the end, every single technology has to compete unsubsidized in the marketplace against fossil fuels.”

While Khosla places bets on elusive black swans he’s also funding companies and entrepreneurs recycling old technologies and skills. Take Soladigm, a Santa Rosa, Calif.-based startup founded by a former chip industry veteran that is repurposing semiconductor technology to create windows that darken or lighten to cut heating and cooling costs. Then there’s the Stanford University professor with a specialization in medical cements who founded Calera to create a “green” building cement by mixing carbon emissions from power plants with seawater.

“To me, investing is the necessary evil to have fun with the breakthroughs,” says Khosla. “The fun part is when someone says, ‘Oh that technology is not possible,’ and someone else says, ‘Hey, here’s how I’m going to prove the world wrong.’ It’s rooting for the underdog, helping him win against the conventional wisdom.”

—

Recent news media coverage of Khosla Ventures:

- Venture capitalist Vinod Khosla raises more than $1 billion (San Jose Mercury News)

- Venture Firm’s ‘Green’ Funds Top $1 Billion (New York Times)

- Khosla Ventures’s Take on Tech (Wall Street Journal)