Last month I went home to Barcelona to attend Carbon Expo, one of the major annual gatherings for professionals involved in the global carbon market. There were many interesting conversations and panel discussions over the course of the three-day conference, but one in particular focused on sectoral mechanisms as a way of sourcing international offsets from emerging economies.

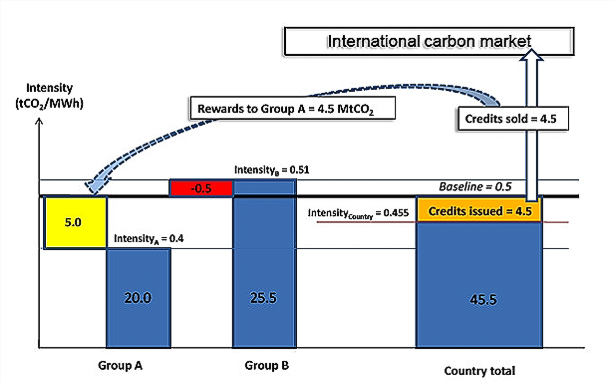

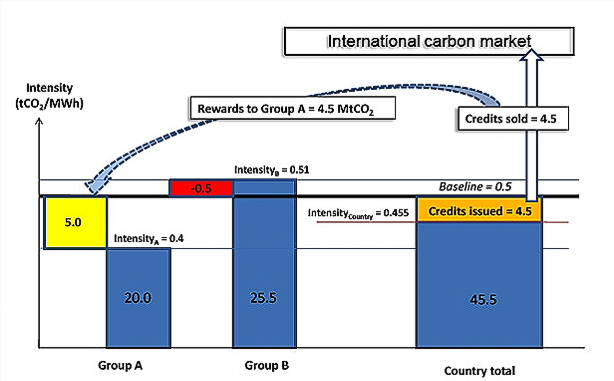

In my last post, I argued that a sectoral mechanism can be a powerful instrument to deliver cost-effective offsets — provided it is able to clearly link investment and subsequent returns from a private sector perspective. In relation to this, one of the panelists from the International Energy Agency (IEA) presented the conclusions from a recent study on sectoral mechanisms and carbon markets (PDF). The slide below, taken from this paper, schematically represents how a sectoral ex-post crediting mechanism may work.

With this approach there are two major problems from a private sector perspective:

1. The credits are sold to the carbon market at a country level (i.e. the government), removing direct access for a private entity to enter the market, which has been one of the most successful features of the Clean Development Mechanism (CDM).

2. A good performance from a private entity does not guarantee carbon credits in return, since it depends on other companies also operating under a country’s baseline. This is completely outside the control of an investor and therefore it introduces an incalculable risk into that investment.

IEA paper via Sonia Medina / EcoSecurities

IEA paper via Sonia Medina / EcoSecurities

The IEA study made the same point:

“the incentive to individual investors in mitigation may be less direct, and therefore weaker than that under a single project configuration like the CDM. Under sector-wide crediting, an entity’s good performance can be offset by the lack of progress of other entities in the sector.”

Furthermore, under the terms of the current Kyoto Protocol, we already have evidence that government-run schemes have not been as successful as the CDM, which has a more clearly defined private sector approach. Joint Implementation and the International Emissions Trading system have failed tremendously to deliver the trading and financial flows that were initially expected of them. It may be argued that this failure to deliver has been caused by the lack of a clear incentive between private sector investment and a transparent carbon reward, since both schemes are heavily dependent on government action.

Another worrying aspect of a sectoral mechanism as described above relates to timing and transition issues. It is clear that a sectoral mechanism will mean a lot more work upfront by host countries in setting up the rules, developing baselines and monitoring procedures. This raises questions as to what would happen to CDM projects that get caught in the middle of this transition. Further still, it raises questions as to how quickly countries can start delivering a flow of credible, high-quality sectoral credits that can be used for compliance commitments. If the supply is not there, the United States and other demand-side countries will see their cost of compliance increase.

One final point regarding sectoral mechanisms, that from my point of view makes them difficult to be a source of reliable compliance-grade offsets, relates to the fungibility of credits across different sectoral crediting schemes. It is not clear if all sectoral mechanisms will be governed by a single entity like the World Trade Organization or the current UN Framework Convention on Climate Change (UNFCCC), or will rely exclusively on host countries.

Worryingly, this may mean that the market could perceive the credits coming from different countries or sectors to be of differing quality, and therefore, it may create fungibility issues. Understandably, the U.S. Environmental Protection Agency may decide at that point to subject those credits to extra checks in order to accept them into a US scheme. If we thought that dealing with the UN was difficult, we can only imagine what it may be like dealing with two governments that have conflicting priorities.

I remain convinced that sectoral mechanisms can be quite powerful if applied correctly, but from what I have seen in the United States and Europe, further debate is required. It is tremendously important we get this right, otherwise it could be a missed opportunity for businesses and governments to tackle climate change cost-effectively, while unleashing large amounts of private capital to develop a new green economy.

It is also of special relevance in the United States because the Waxman-Markey bill clearly relies on offsets as a cost-containment strategy, having established a theoretical limit of 2 billion offsets per year. Domestically, it is already clear that the potential supply will be well below 1 billion, especially if the EPA ends up regulating landfills and coal mine-methane.

Therefore, international offsets need to play a crucial role in controlling costs of compliance in the United States. If sectoral mechanisms fail to deliver, as I think they will, then U.S. businesses will face a tremendous shortage of offsets and will suffer from an unexpected increase in compliance costs.