The Department of Energy announced on Friday that the first energy loan guarantee authorized by the 2005 (!) Energy Policy Act went to a plant that manufactures solar panels:

Energy Secretary Steven Chu today offered a $535 million loan guarantee for Solyndra, Inc. to support the company’s construction of a commercial-scale manufacturing plant for its proprietary cylindrical solar photovoltaic panels. The company expects to create thousands of new jobs in the U.S. while deploying its solar panels across the U.S. and around the world.

“This investment is part of President Obama’s aggressive strategy to put Americans back to work and reduce our dependence on foreign oil by developing clean, renewable sources of energy,” Secretary Chu said. “We can create millions of new, good paying jobs that can’t be outsourced. Instead of relying on imports from other countries to meet our energy needs, we’ll rely on America’s innovation, America’s resources, and America’s workers.”

[Note to Chu and DOE press team: Next time, please don’t issue such big, newsworthy announcements on Fridays. That’s when the previous administration would release news they wanted to bury (see “The four global warming impact studies Bush tried to bury in his final days“).]

Ironically, this loan program was “established to speed the deployment of low-carbon energy technologies but has been plagued-to the consternation of lawmakers-by delays stemming mainly from policy disputes between the Bush administration DOE and Office of Management and Budget,” as Energy Daily ($ub. req’d) noted.

That’s right — for over two years, the Bush administration couldn’t even decide amongst itself how to use these loans. But then again all of Bush’s pro-technology talk was just that — talk (see here).

Here are more details from DOE on the company that got the loan:

Solyndra’s photovoltaic systems are designed to provide the lowest installed cost and the highest solar electricity output on commercial, industrial and institutional roof tops, which are a vast, underutilized resource for the distributed generation of clean electricity. Solyndra’s proprietary design transforms glass tubes into high performance photovoltaic panels which are simple and inexpensive to install. By replacing power generated from fossil fuel sources, the electricity produced from the solar panels will reduce emissions of greenhouse gases.

Based in Fremont, CA, Solyndra is currently ramping up production in its initial manufacturing facilities. Once finalized, the DOE loan guarantee will enable the company to build and operate its manufacturing processes at full commercial scale.

Solyndra estimates that:

- The construction of this complex will employ approximately 3,000 people.

- The operation of the facility will create over 1,000 jobs in the United States.

- The installation of these panels will create hundreds of additional jobs in the United States.

- The commercialization of this technology is expected to then be duplicated in multiple other manufacturing facilities.

Further details on the potential advantages of their technology are below.

Here are some more details on how this loan will operate:

Secretary Chu is offering the loan guarantee by signing a “conditional commitment” today, following approval this week by the Department of Energy’s Credit Review Board. Just as homebuyers who have been approved for a loan are required to meet certain conditions before closing, the conditional commitment will require Solyndra to meet an equity commitment as well as other conditions prior to closing. Today’s action signals the Department’s intent to move forward on Solyndra’s application for $535 million loan guarantee provided the company meets its obligations.

Before offering a conditional commitment, DOE takes significant steps to ensure risks are properly mitigated for each project prior to approval for closing of a loan guarantee. The Department performs due diligence on all projects, including a thorough investigation and analysis of each project’s financial, technical and legal strengths and weaknesses. In addition to the underwriting and due diligence process, each project is reviewed in consultation with independent consultants.

Here are comments from Senate Energy and Natural Resources Committee chair Jeff Bingaman (D-N.M.):

After years of watching this program struggle to get off the ground, it’s encouraging to see that Secretary Chu’s energetic new leadership at the Department is having an effect. This news is especially welcome at a time when our nation’s economic problems have made it so difficult for companies to find financing for clean energy projects. Congress soon will be considering a new energy bill, and that legislation is likely to include additional authorities for the Secretary and the Administration to help build a new green energy economy for America.”

Scientific American had a good story in October on Solyndra (here).

Energy Daily has more recent details:

Since its founding in 2005 in Fremont, Calif., privately held Solyndra has been developing technology and ramping up manufacturing capacity to produce its proprietary thin film PV system that uses copper, iridium, gallium and selenium (CIGS) rather than silicon.

While thin-film PV typically is about half as efficient as silicon-based PV in converting sunlight to electricity, Solyndra’s system offers design features that allow the generation of considerably more electricity from flat roofs, at a lower installed cost, than flat-panel PV systems, the company says.

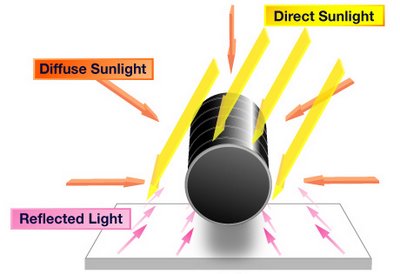

Solyndra’s panels employ cylindrical modules that capture sunlight across a 360-degree photovoltaic surface capable of converting direct, diffuse and reflected sunlight into electricity. This self-tracking design eliminates the need for expensive tilted mounting devices required by traditional silicon PV panels to improve the capture of direct light.

The cylindrical modules consist of two glass tubes, one nested within the other. The inner tube is covered with the CIGS thin film, while the outer tube focuses sunlight on the thin film and protects the PV cell. Solyndra’s panels perform optimally when mounted horizontally and packed closely together, making them ideal for the flat roofs found at commercial and industrial facilities throughout the United States and around the world.

Solyndra is currently shipping its systems, comprised of panels and mounting hardware, to fulfill more than $1.2 billion of multi-year contracts with customers in Europe and the United States. A spokesman said Solyndra’s existing, fully automated manufacturing facility in Fremont is ramping towards 110 megawatts per year of capacity.

The DOE-guaranteed loan, expected to provide debt financing for about 73 percent of the project costs, will allow Solyndra to begin construction on a second manufacturing plant. When it is completed, the new plant is expected to have an annual manufacturing capacity of 500 MW-which would place the company among the world’s biggest thin film panel makers.

Over its lifetime of the project, the new plant will produce enough solar panels to generate up to 15 gigawatts of solar electricity, enough to avoid 300 million metric tons of carbon dioxide, the main greenhouse gas.

The company currently employs more than 500 people, and estimated that construction of the new plant will employ 3,000 workers, while its operation will create more than 1,000 new jobs.

Solyndra’s financial backers include CMEA Ventures, Madrone Capital Partners, Rockport Capital Partners and Virgin Green Fund.

Yes — venture capital has been critical to the recent explosion in U.S. clean energy companies (see here).

Kudos to Chu for jumpstarting the loan program and focusing on the key job creating technologies of this century — renewable energy.

This post was created for ClimateProgress.org, a project of the Center for American Progress Action Fund.