At the corner of a busy intersection in East Oakland sits a three-story apartment building that looks like many others in Northern California. As with many buildings in the notoriously housing-starved Bay Area, its tenants aren’t always happy.

A complaint filed last year claimed that a third-floor apartment had leaking windows and mold. One from 2019 reported that the landlord was attempting to convert a crawl space into five bedrooms. City inspectors verified the complaint and found that the landlord began construction without securing the necessary permits — and the rooms had leaking sewer and plumbing lines and were lacking “adequate means of egress.”

Given this history as well as the building’s age — it was built in 1950 — it might be no surprise that the structure scored poorly on energy and water audits conducted last year. It scored in the 45th percentile for energy use and a pitiful 14th for water use.

When the building’s owner, Frank Li, refinanced a $6.1 million loan for the property earlier this year, the loan was purchased by the behemoth government-supported mortgage company Fannie Mae, who repackaged it as a “green bond” and sold it to investors looking for environmentally friendly assets. In return for borrower-friendly loan terms and free energy and water audits, Li agreed to install upgrades to reduce the building’s energy and water use by a combined 30 percent within a year.

Fannie Mae, which along with its sibling company Freddie Mac owns more than 60 percent of all U.S. home mortgages, exists to support affordable housing in the U.S. To do so, it purchases mortgages worth billions of dollars each year from lenders across the country, packages them into financial products called mortgage-backed securities, and sells them to investors, whose investments then allow people like Li to take out new loans to buy new properties or make improvements to ones they already own. When the underlying homes or buildings are considered sustainable — or on the path to becoming so — they’re packaged into “green” mortgage-backed securities, which are considered a type of “green bond.”

Green bonds constitute less than 1 percent of the overall market for bonds — debt sold to investors by public institutions or companies. Over the past decade, demand has skyrocketed for this relatively new financial product, which frequently promises to use investors’ money to finance projects that accelerate decarbonization. Last year alone, close to $270 billion in green bonds were issued worldwide, bringing the total issuance since market inception in 2007 to $1 trillion.

Fannie Mae has issued green bonds totaling more than $95 billion since 2012, making it the single largest issuer of green bonds in the world. Across the nation, its green bonds program, which targets inefficient buildings like Li’s in Oakland, has enrolled thousands of nondescript apartment buildings and complexes.

For property owners, Fannie Mae’s incentives are attractive. Enrollment in the program typically comes with lower interest rates, larger loan amounts, and free energy and water audits. These perks are essentially subsidies intended to drive investments in energy efficiency. The thinking is that providing economic incentives to retrofit existing buildings — which account for nearly a third of greenhouse gas emissions in the country — will help accelerate the transition to a low-carbon world.

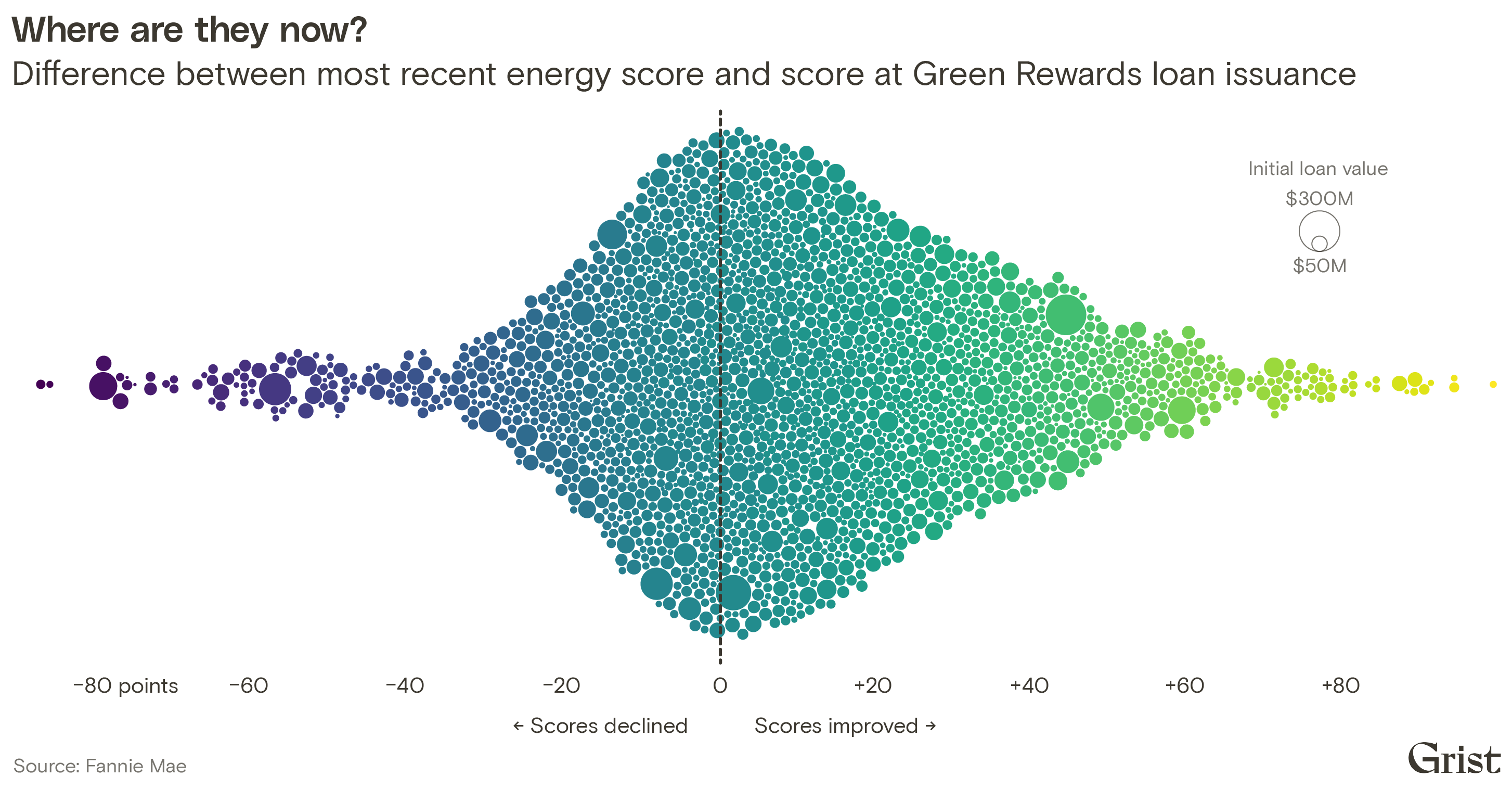

Despite this massive investment, whether or not Fannie Mae’s green bonds program is driving significant decarbonization and efficiency improvements is very much an open question. On one hand, a Grist analysis of the program found that about 1,600 of the 3,800 properties in the program saw improvement in their energy scores within a median period of about two years, indicating that they likely met Fannie Mae’s targets, at least with regard to energy use. (The program only began reporting water use scores in 2019.) But of the 1,600 properties that improved, about 700 saw their energy scores later stagnate or dip. Overall, more than 800 properties in Fannie Mae’s dataset saw lower or identical energy scores in the most recent data year compared to their scores at loan issuance. That means some buildings actually became less efficient after being enrolled in the program. The loans on these stagnating or declining buildings were valued at $16.5 billion at the time of issuance.

Many buildings’ failures to reduce their energy use may be due to the program’s initial structure, according to Aleksandrs Rozens, a Fannie Mae spokesperson. For the first few years, Fannie Mae accepted either energy or water use reductions to meet its criteria. As a result, some buildings with stagnant energy scores may have met requirements by simply lowering their water use, but Grist was unable to verify this due to a lack of data. Perhaps recognizing that this program design did not guarantee energy savings, in 2019 Fannie Mae began requiring minimum energy use reductions of 15 percent.

Still, the value of the program is unclear even in cases where energy savings did improve: About a fifth of the buildings enrolled from 2016 through 2019 performed worse than the median U.S. building even after fulfilling program requirements. Part of this finding is due to the very low percentiles in which many buildings enter the program — meaning even large gains won’t catch them up with the median. But part is also due to the fact that some buildings may have elected to primarily or even solely reduce water use.

There’s also a question of whether or not the program is stimulating efficiency investments that would not have occurred without it. Participation is highest in states and cities that already have stringent building energy efficiency codes, indicating that some of these building owners may have pursued green improvements without Fannie Mae’s incentives. About 20 percent of green bond issuances are in California and Illinois, states with aggressive sustainability policies.

Since 2015, Fannie Mae has offered two pathways for building owners to secure eligibility for green loans: They can provide evidence that their buildings have obtained one of 40 sustainability certifications approved by the company (such as Leadership in Energy and Environmental Design, or LEED). Or they can promise to install improvements that reduce water and energy use by a combined 30 percent within a year of securing a loan. The programs are called Green Building Certifications and Green Rewards, respectively, and the vast majority of participants, like Li, are enrolled in the latter. Fannie Mae claims that the programs have been hugely successful in driving investments toward environmentally sustainable buildings and cutting the carbon footprint of the real estate sector. In a recent publication, CEO Hugh Frater boasted that the program had helped prevent an estimated 634,000 metric tons of carbon dioxide equivalent — akin to taking 138,000 cars off the road for a year — and reduced tenant utility costs by $146 million. “Doing well as a company is inseparable from doing good for the communities we serve,” he wrote.

Whether Li’s Oakland building will meet Fannie Mae’s required target is unclear. Grist was unable to reach Li himself, but the building’s property manager, who identified himself as Tom, said Li had installed new windows, energy-efficient air conditioning, and LED bulbs in the past year in part to meet California’s building efficiency standards. (Li also began work to legalize the units that the city found he had failed to properly permit.) He said he wasn’t privy to Li’s financial agreements and was unaware of any requirements by the mortgage company to reduce energy and water use at the property.

Jesse Keenan, an associate professor of real estate at Tulane University, said he has long been concerned that Fannie Mae sets too low of a bar to qualify for its green bond program. “The fundamental problem is the subsidization of very poor-quality buildings, which is greenwashing,” he said. “The future of climate change is on green bonds and flowing capital, and we’re looking at some measure of greenwashing in the largest program in the world. I think we can do better.”

Fannie Mae disputes this characterization. “Properties dedicated to housing working families are rarely newly constructed, energy-efficient homes,” said Rozens. “If we limit the green bond market to only the most efficient green buildings, we would exclude underserved communities, resulting in working families potentially spending greater percentages of their income on utility costs, and exacerbating economic inequality.”

Stuart Brodsky, a clinical assistant professor of sustainable real estate development at New York University, said Fannie Mae’s programs may be stimulating marginal energy savings in buildings that would not have otherwise occurred — despite it being difficult to quantify exactly what those savings are. He pointed out that technical improvements alone can’t guarantee overall performance improvements: Things like building management, tenant behavior, and occupancy levels can fluctuate dramatically within buildings, perhaps weakening some of the program’s benefits.

“I applaud the fact that this program stimulates improvement in efficiency across the building stock, and not just among recognized buildings that are in the best quartile,” he said. “There’s more carbon to be saved through cost-effective measures and focusing on improving incrementally.”

Greenwashing and ‘greeniums’

Questions about what should qualify as a “green” bond have dogged issuers since they first introduced the products a little more than a decade ago. Because there are no mandatory international standards, an issuer can slap the label on any bond. Infamously, the Chinese government included “clean coal” projects in the green bonds it offered, while oil and oil-shipping companies like Repsol SA and Teekay Shuttle Tankers have also tried to issue green bonds to fund internal energy efficiency measures.

To guard against greenwashing, Wall Street firms like Standard & Poor’s and Moody’s, which have long rated the quality of products on the bond market, offer outside opinions on whether green bonds will actually fund projects that are environmentally sustainable. Specialty companies like Norway-based CICERO Shades of Green, which certifies Fannie Mae’s green bonds, have also sprung up to try to provide quality control with green bond certification standards. But obtaining the certifications is voluntary. Further, the criteria for assessment vary from company to company, and — as with all bond ratings and sustainability certifications — a conflict of interest exists, because the bond issuer pays the certification company to verify the greenness of a bond. CICERO, for instance, charges $20,000 to $25,000 for its certificate.

Whether green bonds are providing capital for environmental projects that accelerate the clean energy transition is a central concern for their investors. Recent research has shown that investors are willing to accept lower interest rates for green bonds than they would for conventional bonds. The resulting loss in monetary returns has been referred to as a “green premium” or “greenium” that investors willfully pay to support sustainability investments.

“Investors are looking for an impact,” said Carmelo Latino, a researcher who has been studying green bonds at Germany’s Leibniz Institute for Financial Research SAFE. “Investors want to be really sure that there is an environmental impact, otherwise there is no reason to invest in green bonds.”

Latino said that it’s likely that investors in Fannie Mae’s green bonds are willingly paying the “greenium,” given that the bonds have been certified by CICERO and the company has a reputation as the largest bond issuer in the world. In other words, they’re subsidizing the buildings enrolled in the program — which makes the question of whether or not those buildings are actually decarbonizing in any significant way all the more pressing.

‘The lowest common denominator approach’

Of the $95 billion in green bonds issued by Fannie Mae so far, about 80 percent are through its Green Rewards program — the one Frank Li, the Oakland building owner, is enrolled in, where property owners commit to installing improvements projected to reduce energy and water use by 30 percent combined. The reason so many choose this program over the Green Building Certification program is that Fannie Mae pays the cost of energy and water audits, whereas the property owners themselves must pay for third-party certification.

In order to assess the effectiveness of the Green Rewards program, Grist obtained publicly available data from Fannie Mae’s website and analyzed the energy scores assigned to buildings at the time of loan issuance and in subsequent years. Of the 2,300 properties for which multiple years of energy scores were available, about one-third — 842 properties — saw lower or identical scores in the following years compared to the year of loan issuance.

Take Magnolia Crossing Apartments in Macon, Georgia. The complex has 116 units and was built in 1980. In 2018, when a $6.1 million loan was issued for the property, it received an energy score in the 89th percentile. The following year, the score increased to the 100th, in line with Fannie Mae’s conditions to reduce energy use. In 2020, however, the score dipped all the way down to the 27th percentile. While Fannie Mae did not publicly disclose the building’s water score for 2018, the data show that the building’s water score decreased from the 84th percentile in 2019 to the 77th in 2020.

In public documents, Fannie Mae estimated that enrollment of this property in its Green Rewards program led to water savings of 1.5 million gallons and avoided 22 metric tons of emissions of carbon dioxide equivalent, the amount of carbon 27 acres of forest can sequester in a single year. In a spreadsheet detailing the savings, Fannie Mae noted that its estimate may not reflect true savings: “There can be no assurance that any particular savings will be achieved at any given mortgaged property,” it warns, adding that the company “disclaims any liability for the failure of any mortgaged property to achieve any particular energy, emissions, or water usage savings.” The company also has no obligation to update its estimates, it noted.

Fannie Mae does have some mechanisms to verify whether a borrower has improved their property to meet the Green Rewards targets. Borrowers are required to self-report energy use through a portal every year over the life of the loan. Fannie Mae also trains lenders to inspect properties to ensure they’re meeting the requirements of the loan. Additionally, the company has hired a third-party auditing firm to inspect properties at the time the loan is issued and a year after. However, if a borrower fails to make energy and water efficiency upgrades, investors have little recourse.

And according to Avis Devine, an associate professor of real estate at York University in Toronto, Fannie Mae doesn’t make punitive adjustments to interest rates when borrowers fail to meet the program’s requirements. “They’ve got the carrots,” she told Grist. “But there’s literally no enforcement.”

Since borrowers typically include the cost of improvements in the loan amount, a failure to reduce energy and water consumption could theoretically lead to the lender and Fannie Mae holding the loan in default and foreclosing on the property. It’s unclear how often that occurs, especially if a borrower continues to make payments on the loan.

Fannie Mae’s Green Building Certification program, which as of late June accounted for about $17 billion in issuances, has its own set of limitations. The company has grouped the 40 certifications it recognizes into four tiers, with the top tier requiring a 50 percent reduction in energy use and the bottom tier requiring just a 10 percent reduction in energy use, compared to a national baseline. At least 130 properties with issuances worth close to $5 billion occupy the bottom tier.

This lax requirement is a shortcoming of the program that CICERO, the certification company, has warned against. CICERO rated Fannie Mae’s green bond programs “light green” — the lowest rating on its “shades of green” scale that indicates some measure of sustainability. “It is possible to pass through their filtering system without having a very strong building certification,” said Christa Clapp, a managing partner and co-founder of CICERO. “We had to think through the lowest common denominator approach and what could qualify as a green building. That’s why we ended up with the light green.”

Of the more than 230 green bond reviews that CICERO has posted publicly, just 17 have received this lowest, light-green rating. Three of those are reviews of Fannie Mae and Freddie Mac programs. Others have been issued for an international airport in Delhi, India, a Belgian warehouse company with growing emissions, and an oil-shipping company. According to CICERO, a light-green rating is typically issued to “efficiency investments for fossil fuel technologies where clean alternatives are not available.”

Of the 40 green building certifications recognized by Fannie Mae, the most popular is called “Green Globes” and is issued by the nonprofit Green Building Initiative. Fannie Mae recently updated its guidelines to require that all Green Globes certifications be “accompanied by a letter from the Green Building Initiative affirming that the property met minimum energy requirements for certification.” The requirement was added because, as Fannie Mae disclosed to Grist, the company had failed to note that the certificate allowed property owners to install solely water efficiency upgrades. As a result, buildings that qualified for Fannie Mae’s program through the Green Globes certification program may not have reduced energy use at all, the Fannie Mae spokesperson said.

About $1 billion in Fannie Mae green bond issuances are tied to properties approved by the popular LEED certification program. However, a study by researchers at Carnegie Mellon University examining energy usage between 1990 and 2019 at federal buildings that received LEED certification found that the certification has no effect on average energy consumption. “If energy efficiency is the primary policy goal,” the study authors noted, “LEED certification may not be the most effective means to reach that goal.”

Is something better than nothing?

As states and cities set ambitious goals to cut their carbon emissions, aggressive codes and incentives to build energy-efficient buildings and homes are becoming more common. The state of California and at least 25 cities across the country require multifamily property owners to conduct energy audits and report their energy use, which coincidentally is a first step toward participating in Fannie Mae’s Green Rewards program. The governmental measures raise questions about the extent to which Fannie Mae’s incentives, rather than more aggressive state and local ordinances, are driving investment in green buildings.

In order for a climate solution to be effective, it must be characterized by what climate wonks call “additionality.” If green bonds, which are being marketed as a climate solution, are just subsidizing projects that would have happened even without Fannie Mae’s programs, they may be no different than conventional bonds, just with a lower rate of return.

The popularity of Fannie Mae’s green bond program in Chicago, Illinois, may underscore this issue. In 2013, then-Mayor Rahm Emanuel required building owners to conduct energy audits and publicly report their properties’ energy use in an attempt to identify opportunities to cut costs and reduce energy use. The city also removed various bureaucratic hurdles to retrofitting homes and buildings by slashing fees and permit wait times.

Perhaps as a result, Chicago is the city that has seen the largest demand for Fannie Mae’s green bonds, with a total $3.6 billion being issued to date. An analysis of the bond program by researchers at York University in Toronto and University of Tulsa in Oklahoma also found that 49 to 65 percent of all Fannie Mae issuances for properties in Illinois qualified for the green bond program. No other state scored as high.

Avis Devine, one of the authors of the study, said Illinois had a high green-building adoption rate because “it had both a carrot and a stick.” A 1995 heat wave in Chicago that resulted in the death of 735 people pushed communities to think proactively about climate resilience and environmental sustainability, and incentives to improve the energy efficiency of buildings also likely increased the number of buildings that adopted sustainability measures. As a result, many of the Chicago buildings would’ve automatically met the green bond program’s requirements. “You put those two things together and what you get is an outsized commitment to environmentally sustainable buildings,” she said.

Rozens, the Fannie Mae spokesperson, said that “it is impractical to parse program eligibility based on location and constantly changing codes; therefore, we use the same eligibility standards nationwide. Regardless of the property owner’s motivation for obtaining a green building certification, Fannie Mae is dedicated to financing the solution for the market.”

Last year, Fannie Mae opened up its green bond program to single-family housing, requiring dwellings to perform 29 percent better than the national baseline for energy use. So far the company has issued just 31 bonds worth a total of $245 million. While the program is still in its infancy, there are already signs it may suffer from problems similar to those in the multifamily program.

CICERO rated the new scheme “light green” and pointed to the fact that “many states already adopted higher building codes.” In fact, at least 39 states have rules on the books that require energy savings that are close to or higher than the requirements to qualify for Fannie Mae’s green bond program.

Fannie Mae’s requirements simply are not stringent enough to align with the targets of the Paris Agreement, which calls for close to zero-energy buildings by mid-century, said Clapp, the co-founder of CICERO. “They need to tighten over time if they want to be eligible for a darker green shading.”

The concerns around the program’s additionality led Keenan, the Tulane University professor, to include Fannie Mae’s green bond program as a case study earlier this year in a graduate-level class on sustainable real estate. The assignment asks students to assess whether an investment in the program would result in measurable reductions in environmental harms.

Keenan, who reviewed Grist’s analysis, said that our findings confirmed his concerns. “No building should become less efficient in such a short amount of time,” he said. “It’s shown here that people are making some improvements, but in general you’re still subsidizing pretty terrible buildings.”

Update: The story has been updated to reflect that property owners enrolled in the Green Rewards program commit to improvements that lenders project reduce energy and water use by 30 percent.